How to pay less taxes

Reducing your taxable income and lowering the amount of taxes owed are some of the most effective ways to take control of your personal finances. By taking the time to understand the right deductions and credits to claim, you can keep more of your hard-earned money in your pocket come tax time.

This guide explains how to identify tax-saving opportunities for filing this year, so you can plan ahead and make the most of the deductions and credits available to you.

Key takeaways

- Review the credits and deductions you're eligible for to potentially reduce this year's tax bill.

- Tax-advantaged accounts, charitable giving and family-focused tax breaks are ways to reduce taxes owed.

- Connect with a financial professional to ensure you're maximizing your savings opportunities.

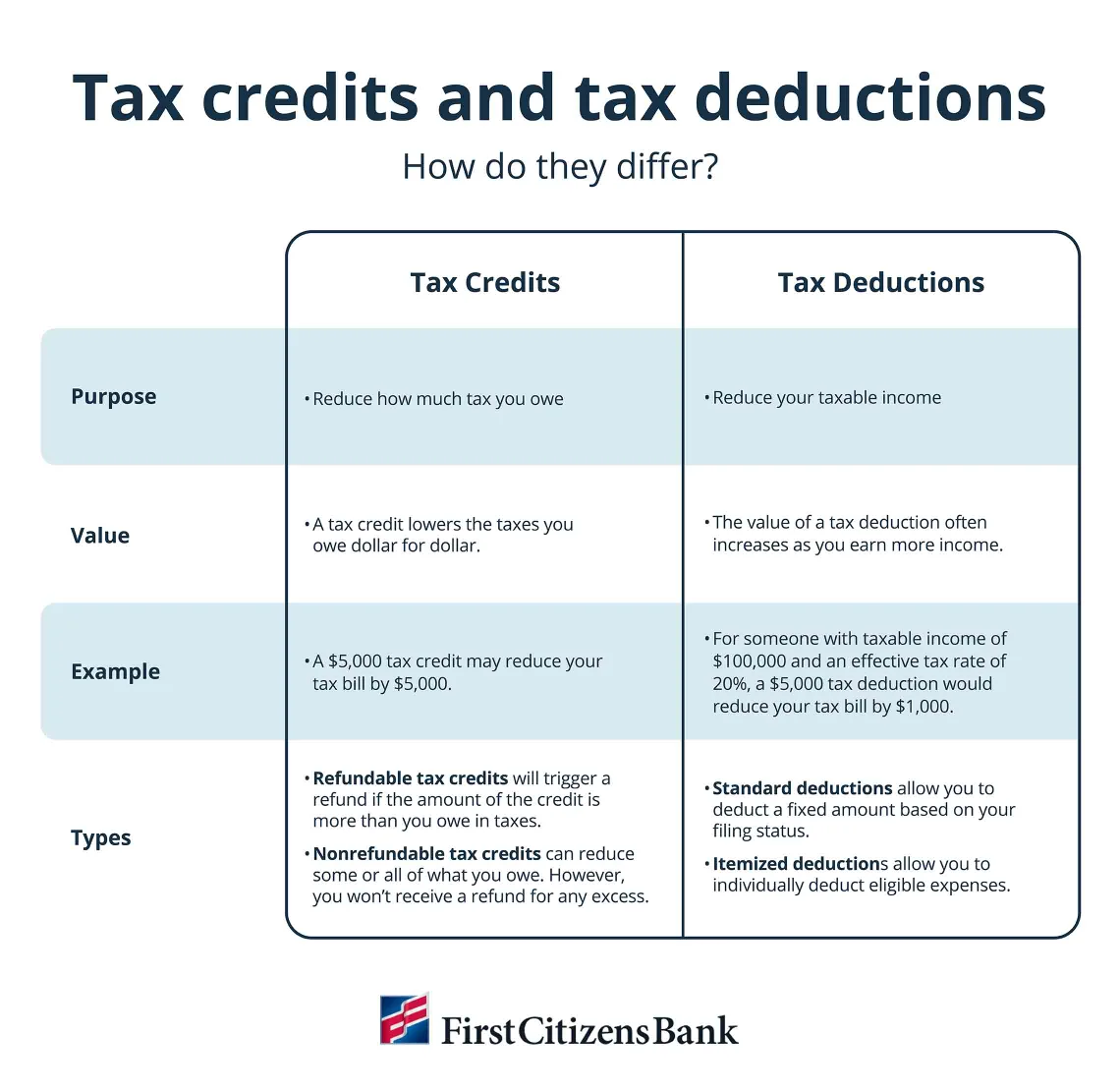

The difference between tax credits and deductions

Most tax-reduction strategies fall into two categories: tax credits and tax deductions. Credits directly lower the tax you owe, while deductions reduce the income the IRS uses to calculate your tax. For the most current credit and deduction amounts, review annual IRS updates.

How do tax credits work?

Tax credits provide a dollar-for-dollar reduction of your tax liability. For example, a $2,000 tax credit reduces your tax bill by exactly $2,000. Some credits are refundable, meaning you could receive money back if the credit amount exceeds the tax you owe. Nonrefundable credits can reduce your tax liability to zero, but you won't receive a refund for any excess amount.

How do tax deductions work?

Tax deductions lower the amount of income that's subject to tax. Your actual savings depend on your marginal tax bracket. For instance, if you're in a 22% tax bracket and claim a $5,000 deduction, your tax bill decreases by $1,100, which you can get by multiplying $5,000 by 0.22.

Should you take the standard deduction or itemize?

When filing your taxes, you must choose between taking the standard deduction and itemizing your deductions. If the total of your eligible itemized deductions—such as mortgage interest, state and local taxes, and charitable gifts—exceeds your standard deduction amount, itemizing will provide greater savings.

When should you take the standard deduction?

Let's say Sarah is a renter with no mortgage and relatively low out-of-pocket medical and charitable expenses. When she totals her potential itemized deductions—including state taxes and minor donations—they add up to less than the standard deduction, so Sarah chooses the standard deduction. This approach simplifies her tax filing and ensures she gets the maximum deduction available to her that year.

When should you itemize your deductions?

Let's say David and Lena are homeowners with larger deductible expenses. Their annual totals include $25,000 in mortgage interest, $6,500 in property taxes and $3,500 in charitable contributions, for a combined $35,000. This exceeds the standard deduction available for their joint return. David and Lena itemize, reducing their taxable income more than the standard deduction would allow—giving them a financial benefit for documenting their qualifying expenses each year.

Which tax credits and deductions offer the biggest savings?

Many valuable tax breaks are designed for personal circumstances, from raising a family to saving for retirement.

Tax credits for families

Raising children comes with financial challenges. Several tax credits can help manage these costs, although many are subject to income-based phaseouts.

- Child Tax Credit: You can claim a credit for each qualifying child under age 17.

- Child and Dependent Care Credit: You might be eligible for this credit if you paid for care for a child under 13 or another qualifying dependent so you could work. The credit is a percentage of your expenses, with a limit.

- Adoption Credit: This credit can help offset qualified expenses per child. These expenses can include home study, travel, adoption fees and court costs.

Education tax credits

With the rising cost of higher education, two tax credits can help offset some expenses. Both are subject to income limitations.

- American Opportunity Tax Credit: This helps with costs for the first 4 years of undergraduate education. You can claim per eligible student per year.

- Lifetime Learning Credit: This can help pay for undergraduate, graduate and professional-degree courses—including courses taken to acquire job skills.

Deductions for all taxpayers

Certain deductions, known as above-the-line deductions, are available even if you don't itemize.

- Student loan interest: You can deduct some interest paid on a qualified student loan. Income limits apply.

- Educator expenses: Eligible K-12 educators can deduct up to a certain amount for unreimbursed classroom expenses.

- Penalties on early withdrawal of savings: If you paid a penalty for withdrawing funds early from a certificate of deposit account, you can deduct the penalty amount.

- Moving expenses for military: Active-duty military members can deduct unreimbursed moving expenses for a permanent change of station.

- Charitable deductions: You can deduct a certain portion of charitable cash donations to qualified public charities. This deduction excludes contributions to donor advised funds and private charities.

Deductions for itemizers only

If you itemize, you gain access to another tier of valuable deductions.

- Homeowner tax breaks: You can deduct a significant amount of interest on mortgage debt. Interest on a home equity loan or a home equity line of credit, or HELOC, is also deductible if you use the funds to buy, build or substantially improve your home. Opening a HELOC can be a smart way to fund major renovations while gaining a tax benefit.

- State and local taxes: Also known as SALT, you can use this to deduct a combination of property taxes and either state income taxes or state sales taxes. For example, if you paid $4,000 in property taxes and $3,000 in state income taxes, you could deduct $7,000. If you paid $4,000 in property taxes and $2,500 in state sales taxes, you could deduct $6,500. The key is to choose the option that provides the greater tax benefit based on your specific payments.

- Charitable donations: You can deduct larger contributions made to qualified charitable organizations.

- Medical expenses: You can deduct some qualified, unreimbursed medical expenses.

How can you maximize the SALT deduction?

Let's say Alex owns a home and pays both property taxes and state income taxes. She lives in a state with high property and income taxes, which makes the SALT deduction a critical consideration for her tax planning. After reviewing her options, Alex chooses to itemize her deductions instead of taking the standard deduction because itemizing provides the greatest tax benefit within the SALT deduction cap.

Maximize your savings with tax-advantaged accounts

Contributing to retirement and health savings accounts, or HSAs, is a tax-smart strategy.

- Traditional IRA and 401(k) contributions: Contributions made to a 401(k) or traditional IRA reduce your taxable income for the year. If you're 50 or older, you can make additional catch-up contributions.

- HSA: If you have a high-deductible health plan, an HSA provides a triple tax advantage for qualified medical expenses: tax-deductible contributions, tax-free growth and tax-free withdrawals. An HSA can also serve as both a healthcare fund and a powerful retirement savings tool.

How does timing affect your taxable income reduction?

Adjusting when you receive income or pay expenses can meaningfully influence your tax bill.

- Income deferral: If possible, consider delaying bonuses or freelance payments until the next tax year to lower your current year's income.

- Deduction acceleration: Prepay deductible expenses, such as property taxes or a large charitable donation, before December 31 so you can claim the deduction in the current tax year.

- Managing capital gains: Timing matters when selling investments like stocks and real estate. Assets held for more than a year are taxed at lower long-term capital gains rates, while assets held for a year or less are taxed at the higher ordinary income rate.

The bottom line

Exploring how to pay less taxes can lead to significant savings. Tax laws change regularly, so consulting a tax professional is recommended for personalized, up-to-date guidance. They can help you apply these strategies to your situation and ensure you claim every credit and deduction you deserve.

Take time to speak to a financial advisor to help you determine how your tax plan fits into your broader financial goals.