4 financial scams to watch out for

Financial fraud is nothing new. The first recorded attempt of a financial scam dates back to 300 BC, when a Greek merchant planned to sink his boat and collect on the insurance value.

In the 2,300 years since then, society and technology have evolved dramatically—and so have scammers. While insurance fraud still occurs, financial scams have become more varied and complex, creating an environment where it feels like there may be danger at every turn.

Today's financial scams have become increasingly complicated—and costly. From 2021 to 2022 alone, the amount of money lost due to fraud rose by more than 30%.

Who's safe from financial scams?

No groups of consumers are fully safe from financial scams, says David Myroup, Executive Director of Enterprise Fraud Operations for First Citizens. "Bad actors can craft messages to exploit everyone from teenagers to elders. And with the evolution and complexity of AI, or artificial intelligence, the authenticity will be harder to detect."

Through his work with fraud prevention and investigations, Myroup understands how devastating these scams can be. And he says when you know how to recognize financial scams, you're better able to protect yourself. Here are the top four scams plaguing customers as we transition to the new year.

1The bank imposter scam

Typically, bank imposter fraud starts as a text, email or phone call purporting to be from a bank. "You might receive a text message that looks like it's from a bank asking if you made a transaction," Myroup says. "More often than not, there's a link embedded in the body of text."

Once you click the link, you're taken to a site that looks like a bank's website," he adds. "You think you're logging in to authenticate, but by the time you've clicked the button, you're giving your personal information directly to the fraudster."

Another version of the text scam involves telling the target their account is locked and directing them to call the bank number provided in the text. If the target replies to the text, the fraudster will call from a spoofed number that appears to be from the bank.

How to spot bank imposter scams

Fraudsters attempt to invoke an emotional reaction and create a sense of urgency to steal user IDs, passwords and security codes. Reputable banks, including First Citizens, will never reach out to their customers and ask them to share a password or security code. Visit banksneveraskthat.com for an interactive quiz to test your ability to identify a scam.

How to respond

"Don't trust an inbound call or text," Myroup says. Always contact your bank directly by calling the fraud hotline number on the bank's website or on the back of your debit or credit card.

2The pig-butchering scam

Perpetrators of the gruesomely named pig-butchering scam begin by developing a personal but long-distance friendship with a wealthy investor. They nurture an emotional connection over time via digital platforms, like WhatsApp or even LinkedIn. "There are literally camps of people and businesses overseeing the recruitment of bad actors who build relationships with individuals to lure them into investing," Myroup explains.

These criminals often prey on individuals in vulnerable positions or people who are looking for companionship. Once they've won the investor's trust, they'll propose a falsely beneficial investment, often involving cryptocurrency. It may be posed as a business venture or simply a secret shortcut to wealth.

At first, these investments appear to pay off with great returns. This is the fattening-up part of the scam that earns it the name. Then comes the kill, where the criminal disappears with the money. "And then it's all gone," Myroup says.

How to spot pig-butchering scams

Organizations or individuals selling legitimate, regulated investments don't reach out personally to potential investors they don't know. If you're approached on social media and asked to move the conversation to WhatsApp or invest in a venture that you don't understand, your correspondent is likely a scammer.

How to respond

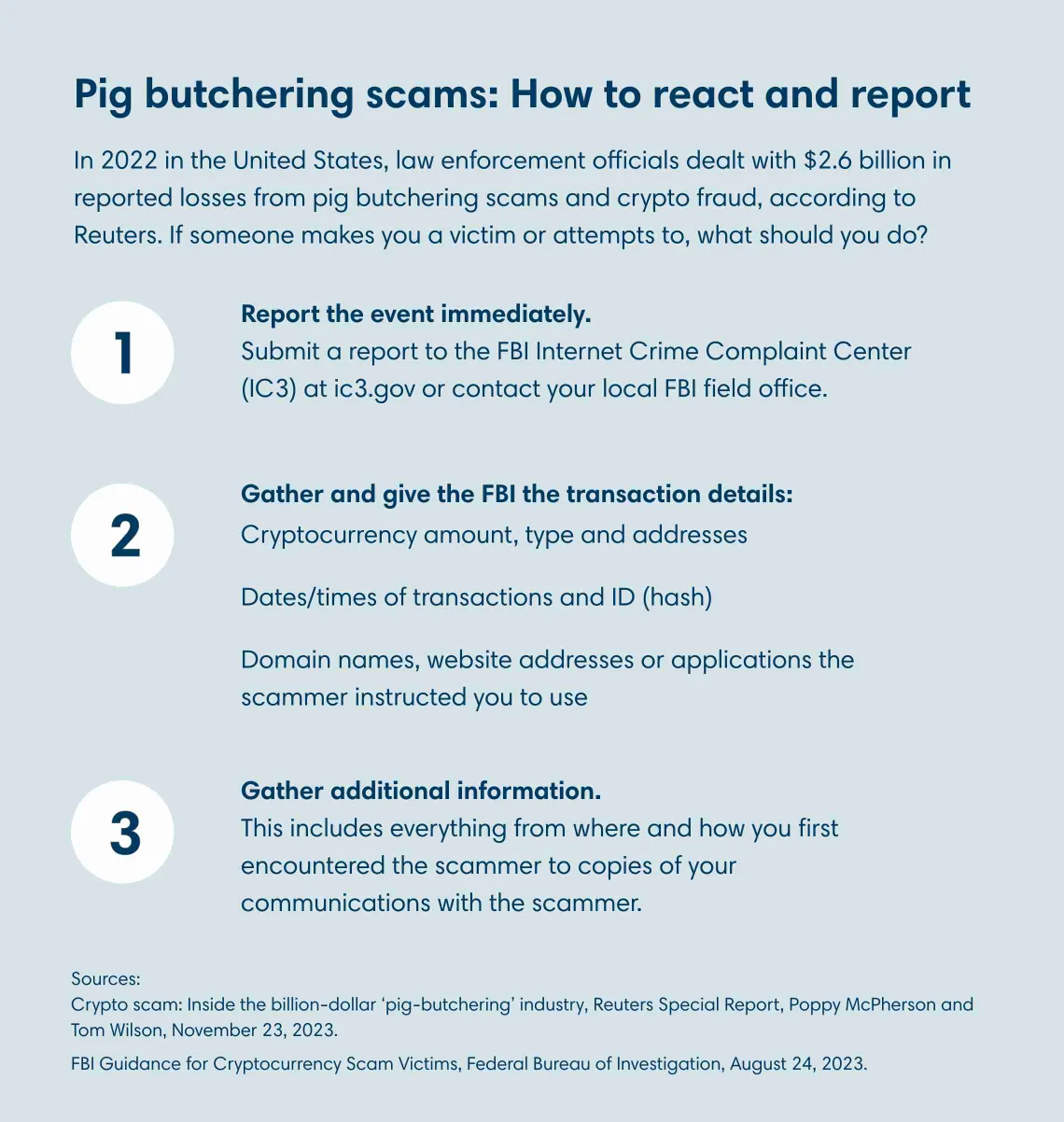

Stop communicating with the scammer, change your login and password credentials and report the incident to your bank. If you've fallen victim, report the crime to the authorities, including the FBI's Internet Crime Complaint Center, your local police and the state attorney general. Monitor your financial accounts for signs of fraud.

3Malware attacks

Malware, short for malicious software, refers to viruses or spyware that infect your work or personal computer. Once malware is installed, criminals use the software to steal personal information, send spam or commit identity theft against you.

How might malware be used in a financial scam? It starts at the internet browser. "Let's say customers want to access their online banking and search First Citizens," Myroup says. "They may see a paid ad versus the actual First Citizens page. When they click on it, they're taken to a site owned by a bad actor."

Once malware is installed, the customer is none the wiser until an unauthorized transaction occurs. It's a twist on the bank imposter scam described at the top of our list of 2024 financial scams.

How to spot malware

Learn to identify the marks of reliable websites, advertisements and mobile apps. Add malware scanning or safe browsing tools to your computer. Keep the operating systems of your phone and computer updated so their security settings automatically look for current threats. When banking, be on alert for unauthorized transactions, as well as alerts from your bank warning you that someone has updated your account phone number or email.

How to protect yourself from malware

Myroup recommends a two-pronged approach. First, enable two-factor authentications on all of your bank logins. Equally important, take advantage of the alerts offered by your bank. "If you get an alert to your phone that somebody has updated a telephone number or email, that is your safety net," he says. "Once they've changed your phone number without you noticing, you're lost."

Some additional protection tips:

- Type your bank URL directly into the browser to get to your online banking login rather than following a link to it.

- Be careful opening attachments in emails.

- Use a dedicated device for banking to minimize the risk of introducing malware through casual web surfing.

- Keep your computer and software updated.

4Advanced impersonation scams

Impersonation scams have been around for many years as a low-tech way of committing financial fraud. In a typical scenario, a grandparent receives a call from someone saying they're a friend of their grandchild who's injured or stranded and needs money.

In this situation, it might not be a friend of that grandchild but simply the grandchild's voice—created with AI audio tools—asking for financial help. These are becoming even more convincing and dangerous as AI becomes part of the scam.

An AI impersonation scam may also come in the form of an even more convincing deep fake, or digitally altered multimedia that makes one person look and sound like someone else. For example, a staff member in a small business may get a video call from the business owner. "The business owner might ask the employee to send a wire over to a customer to close a deal," Myroup says. "The employee sees their boss's face and hears their boss's voice and has no idea that the video call is faked."

How to spot impersonation scams

Because AI fraud starts with gathering the details to impersonate, be wary of people or organizations who reach out unsolicited to ask for personal information belonging to you or a colleague, friend or relative. Be cautious when payment is requested immediately. Question anyone who encourages you to act immediately or send funds via untraceable forms of payment, such as wiring money or sending gift cards.

How to respond to impersonation scams

If something feels off, don't feel pressured to reply or act immediately. Instead, employ what Myroup refers to as the maker-checker process: Hang up the phone and call that person back on the real number you know.

Staying vigilant

No matter what type of scam you might encounter, the important thing to remember is to use caution. The basic rules of scam detection always apply—if it's an email, click to check the email address of the sender instead of just looking at the name. If it's happening over the phone, get a number you can call the person back at and then search to see if it's a legitimate number. By being aware of the types of scams that are prevalent, you can stay alert and work to protect your identity and your loved ones.