How to invest in CDs: Ladder, barbell and bullet

Depending on the rate environment, certificates of deposit, or CDs, may offer an appealing blend of higher interest rates and lower risk. With the right CD investment strategy, they may be an effective tool for both long- and short-term savings goals, offering a balance between growth and liquidity.

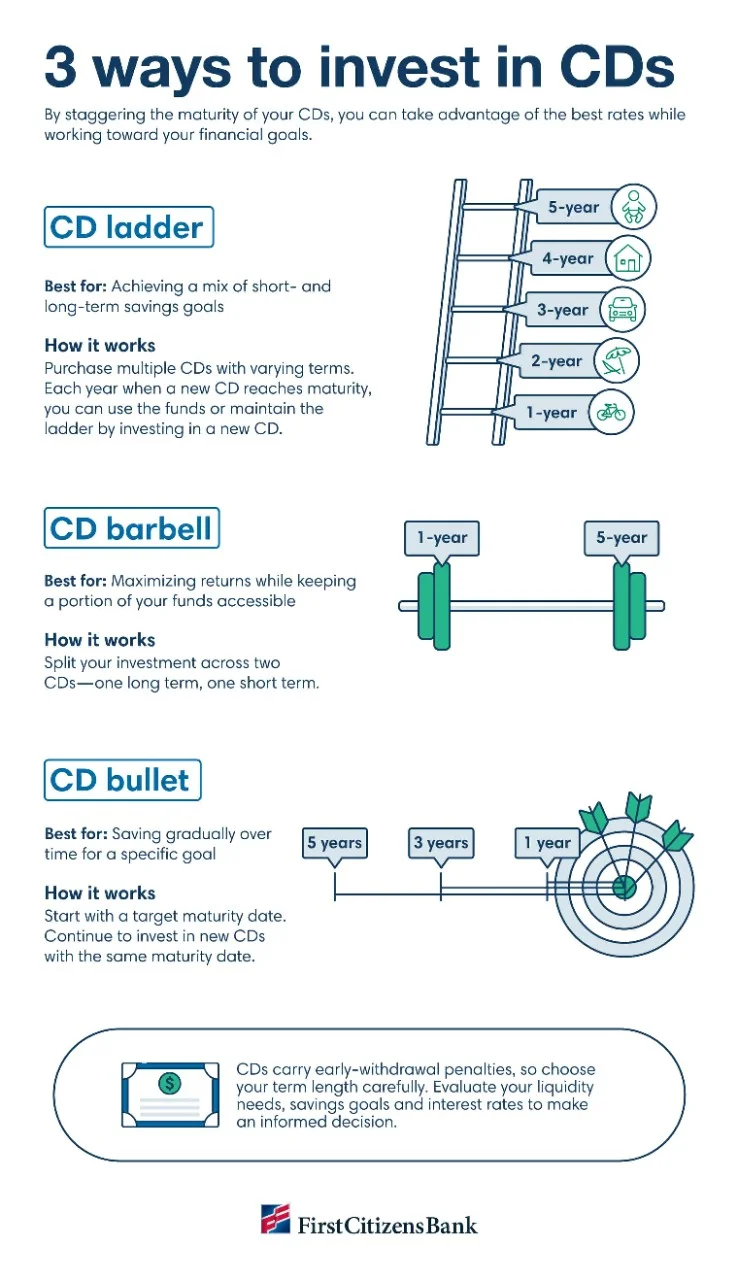

If you're saving for multiple goals on different timelines, there are several strategies you might use to invest in certificates of deposit, including a CD ladder, CD barbell or CD bullet. These strategies allow you to divide funds among multiple CDs tailored to specific savings goals. By staggering the maturity dates of your CDs, you can capitalize on longer-term growth options while having access to liquid funds for distinct spending goals as they arise.

Key takeaways

- In today's rate environment, investing in CDs may offer the growth potential needed to systematically save for and achieve multiple financial goals over time.

- With purposeful financial planning, you can structure your funds to earn robust returns while keeping your sights set on each milestone ahead.

- Remember that you may incur penalties if you access your funds before the maturity date. Before choosing a CD savings strategy, think carefully about your liquidity needs.

The benefits of CDs

As you look ahead to major life milestones, you likely have more than one savings goal in sight. Perhaps you're hoping to buy your first home, finance a wedding or finally take the trip of a lifetime. Reaching these goals requires a dedicated saving strategy. To help, you'll want to maximize growth.

When choosing between a CD and a savings account, access to funds is important. Unlike with a savings account, funds invested in CDs are locked up for a set maturity period in exchange for higher returns. This is where CD investing strategies come into play.

Whether you're focused on one objective or are juggling multiple savings goals, there are creative ways to manage your CDs. Ladders, barbells and bullets are three smart strategies that may help you maximize returns while saving for what matters most.

CD ladders

This strategy staggers multiple CDs to ensure that one always matures at a regular interval, resulting in continual access to maturing funds at typically higher interest rates than traditional savings accounts. Here's how to set up a CD ladder.

- Initiate the ladder. Start by purchasing multiple CDs of the same dollar amount but with progressively longer maturity dates. For example, you might fund CDs with maturity dates of 1 year, 2 years and 3 years.

- Roll it over. When your 1-year CD reaches maturity, reinvest those funds into a new 3-year CD. This ensures that your CD ladder has evenly spaced maturity dates.

- Maintain the structure. Each time another CD in your ladder matures, reinvest it into a new 3-year CD. This keeps your ladder working, allowing you to take advantage of varying interest rates over time.

CD ladder uses

CD ladders can be used for a variety of purposes and savings goals. Depending on the current rate environment, it may also make sense to use CDs for retirement income.

The pros and cons of CD ladders

CD laddering may help you hedge against interest rate changes. Having CDs with different maturity dates can create a safety net against fluctuating interest rates. This is because whether rates rise or fall, a part of your investment will remain optimized.

However, there are two potential downsides to this particular investment strategy. First, CD laddering requires more upfront funds than other CD investing strategies. It's also important to remember that accessing CD funds before their maturity date may incur penalties. If you plan to access funds for an annual expense like a vacation, you'll need to time your maturity dates carefully.

CD barbells

The barbell strategy divides your CD savings so you'll be able to take advantage of two maturity dates, balancing liquidity and your return potential while achieving greater flexibility.

How CD barbells work

A CD barbell involves investing one portion of your funds in a short-term CD—typically with a maturity date of 1 year or less—and another portion of your funds in a longer-term CD. The goal is to maximize your earnings through potentially higher rates on longer-term CDs.

The pros and cons of CD barbells

This strategy may offer the best of both worlds—quicker access to funds and the ability to lock in potentially higher interest rates. Before using this particular strategy, however, it's important to evaluate your personal liquidity needs carefully. Likewise, pay close attention to CD rates. In some cases, banks may offer promotional rates on shorter-term CDs that may be more attractive than rates on CDs with lengthier terms.

CD bullets

Best for targeted savings goals, the CD bullet strategy involves investing in multiple CDs at different times, all with the same target maturity date. This allows you to continually contribute money toward your goal while taking advantage of potentially higher rates on long-term CDs.

How CD bullets work

Start by determining the target maturity date. From there, you can continue to invest in CDs with a maturity date aligned with the goal time frame.

For example, if you're saving to fund a wedding in 2 years, you might invest in one 2-year CD now, a 1-year CD in 12 months and a 6-month CD in 18 months. Or if you're saving to buy a home in 5 years, you might buy a 5-year CD now, a 2-year CD in 3 years and a 1-year CD in 4 years.

The pros and cons of CD bullets

Because it's relatively straightforward and purpose-driven, this strategy excels when you need to save a large amount of money for one goal but don't have all the funds upfront. However, there's some reduced flexibility with this approach. Further, if CD rates drop in the future, your earning potential may not be as great.

Stagger your funds and watch them grow

Looking for ways to do more with your money? Explore rates and terms for our CD accounts to see if laddering is right for you.