CD laddering: A flexible savings strategy with good returns

Because of set terms, certificates of deposit, or CDs, are typically used for longer-term goals and planned expenses. But there's a strategy you might want to consider called CD laddering, which focuses on a shorter-term approach to saving.

This type of savings strategy is ideal for those who want the comfort of FDIC-insured savings along with higher interest rates and protection from market risk. Here's a primer on how CD laddering works and how you may benefit from it.

What is CD laddering?

With CD laddering, you invest money in multiple CDs with different maturity levels instead of investing in one CD and waiting for it to mature. It's designed so that you're always investing in at least one CD and almost always have funds available in case you need them.

How does CD laddering work?

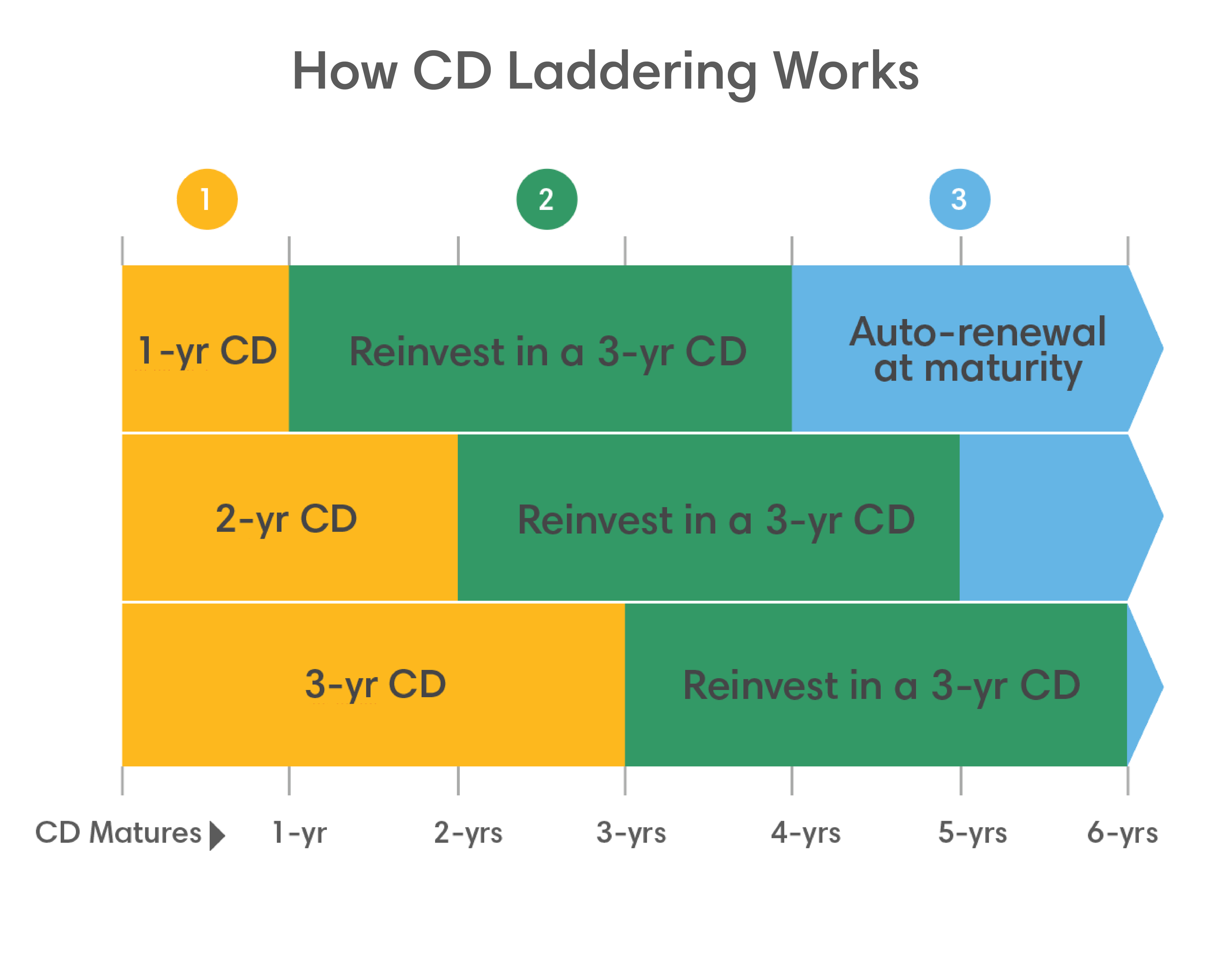

CD laddering spreads your investment among several CDs with staggered terms so there will always be a CD either nearing or at maturity. Each CD can have the same or a different amount, but each should have a different maturity date. In most cases, the longer the maturity date, the higher the annual percentage yield, or APY.

You can invest in CDs with varied terms, depending on how often you want to access your funds. For example, you could spread out a $12,000 investment by putting $4,000 each into a 1-year, 2-year and 3-year CD. When each CD matures, you can take out any funds you need and reinvest the remainder in a CD with the longest term on your ladder—or you can reinvest the entire CD into a new one with a new rate. You choose both the amount and the term length, depending on the market.

CDs will automatically renew at their respective maturity dates, and your investment can continue to grow while you enjoy the interest rate offered by the longest-term CD.

What are the advantages of CD laddering?

In addition to offering a guaranteed rate of return, there are numerous advantages to using CD laddering as part of your savings strategy.

- Low risk: It's a solid way to diversify—and a less volatile investing strategy than stocks.

- Maximized long-term interest: Because longer-term CDs tend to offer a higher APY, you'll earn more from interest.

- Changing rates: As you continually reinvest, you'll benefit from any positive rate changes that occur.

- Predictable cash flow: Set terms help you plan by indicating when you'll have access to your money.

- Protection against inflation: As your money grows with interest, it may keep pace with inflation better.

- Frequent access to funds: Part of your money is always near maturity, so you have potential access if you need it.

- Flexibility: You can choose your terms and plan your investments based on your needs. You can also choose different banks for each of your CDs if you want.

- Security: Most CDs are FDIC insured and offer a fixed rate.

What are the disadvantages of CD laddering?

Just like with other types of investments, there are some potential drawbacks to consider with CD laddering.

- Traditionally low rates: CD rates are typically lower than most other types of investments. If interest rates decline over the life of your CD, you might have to reinvest the matured CD at a lower rate.

- Potentially lower returns: More aggressive and riskier types of investments, such as stocks and bonds, can result in higher returns than CDs.

- Early-withdrawal penalties: This is true for all CDs. If you withdraw money early, you'll incur a penalty—so it's important to let each CD reach full maturity before accessing or reinvesting funds.

The bottom line

CD laddering is a solid way to invest in the shorter term and can be a nice addition to your overall savings strategy. By setting up a CD ladder, you can enjoy the financial flexibility to access funds regularly while earning interest and building your nest egg. If you're unsure where to start with CD laddering, our bankers are here to help. Call or stop by your local branch to get started.

Ladder your funds and watch them grow

Looking for ways to do more with your money? Explore rates and terms for our CD accounts to see if laddering is right for you.