Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Individual retirement accounts, or IRAs, can be a powerful tax-advantaged way to grow your retirement savings. However, IRA withdrawal rules can sometimes be tricky to navigate—and mistakes may be costly.

Whether you're thinking of withdrawing your funds during or before retirement, learning more about IRA withdrawal rules may help you avoid unexpected penalties and surprise tax bills.

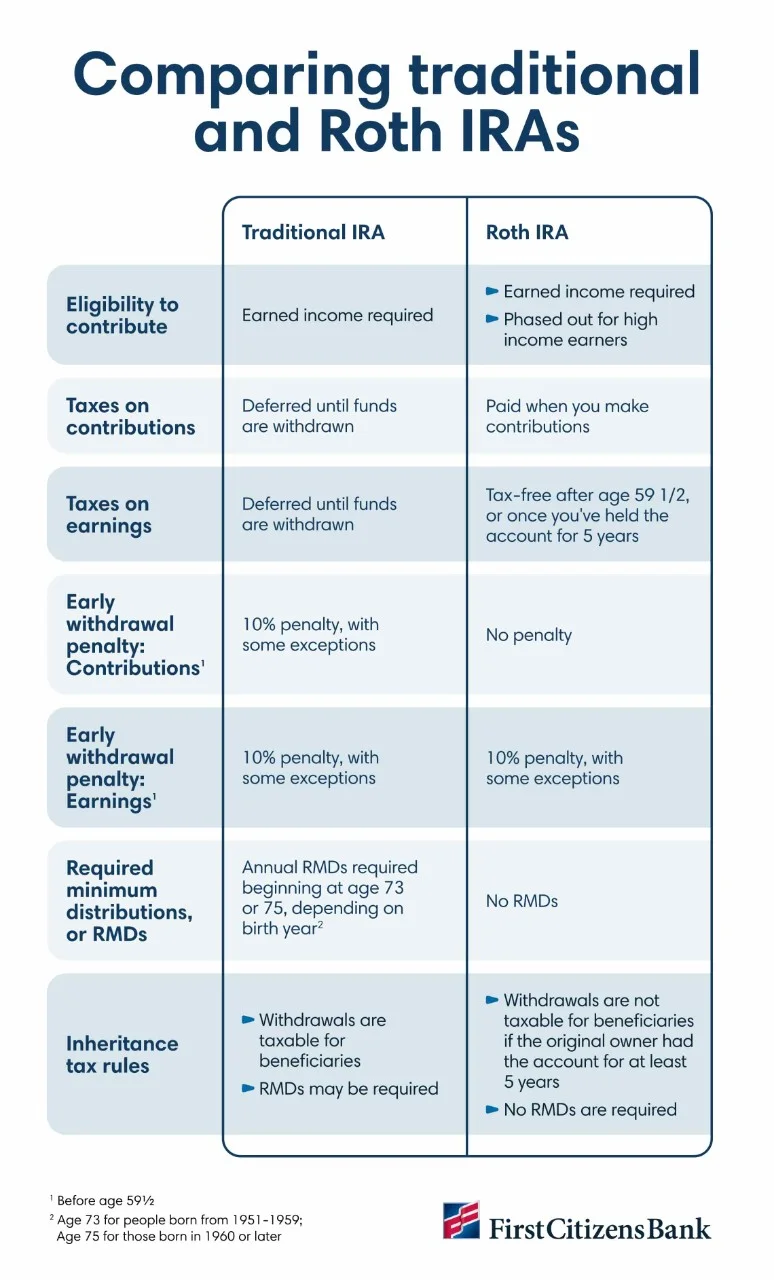

The rules surrounding withdrawals are one of the more significant differences between traditional and Roth IRAs. The type of IRA you own will dictate when you may withdraw your funds without penalty, as well as any tax implications you should be prepared for. Here's a summary of IRA withdrawal rules for each type of account.

You may withdraw money from a traditional IRA without any penalty once you reach age 59 1/2. However, you'll need to pay taxes on those funds.

Also, while it's possible to withdraw funds from a traditional IRA before you reach age 59 1/2, you'll be hit with a 10% penalty if the funds aren't used for a qualified expense or hardship. For example, let's say you're in the 24% tax bracket and want to take an early withdrawal from your traditional IRA to buy a vacation home. If you withdrew $100,000, you'd need to pay $24,000 in taxes and a $10,000 penalty. Plus, depending on how close you are to the next threshold, the withdrawal could push you into a higher tax bracket.

Withdrawals are more flexible with a Roth IRA. Because your original contribution is made using post-tax dollars, you'll be able to withdraw your contributions at any time, for any reason, without paying additional taxes or early withdrawal penalties.

However, depending on when the funds are withdrawn and how long you've owned the account, you may still need to pay taxes on earnings and any funds you may have converted from a traditional IRA.

Be aware that the withdrawal rules and requirements vary for Roth conversions, SEP IRAs, SIMPLE IRAs and inherited IRAs. For example, your options for withdrawing funds from an inherited IRA depend on your status as a designated beneficiary.

If you're under the age of 59 1/2 and need access to your retirement savings, the IRS may waive the 10% early withdrawal penalty if the funds are used for one of the following reasons.

You may be able to avoid paying an early withdrawal penalty for other reasons as well—including transferring your savings to another IRA. In all cases, you'll need to meet certain IRS criteria to qualify for an exemption. It's a good idea to consult a financial advisor to explore your options before taking an early withdrawal.

If you own a Roth IRA, you may leave your savings untouched for as long as you wish. If you own a traditional IRA, however, you'll need to start taking required minimum distributions, or RMDs, once you reach the required age.

Note that if you fail to take your required IRA distribution in full by the deadline, you may be required to pay an excise tax of up to 25% on the amount that should have been withdrawn.

You may delay your first required IRA distribution until April 1 of the following year. However, subsequent IRA distributions must be taken by December 31 of each year. Be aware that if you choose to delay your first RMD, you'll receive two IRA distributions during a single tax year. This may have a significant impact on the amount of tax you'll owe by pushing you into a higher tax bracket.

Your RMD will be calculated based on your life expectancy and how much you saved in the account. While your plan's administrator will notify you of your RMD amount, you may also use an RMD calculator to determine how much you'll need to withdraw.

IRAs offer significant tax advantages that make them an important part of a retirement savings strategy. However, taking IRA withdrawals without considering the impact of taxes and penalties may be a costly mistake.

Learning more about how IRAs work can help you navigate the many rules surrounding both traditional and Roth IRAs. Once you're ready to start taking IRA withdrawals, consult a financial advisor. They can work with you to determine strategic ways to withdraw your savings when needed.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.