Roth IRA versus traditional IRA: Eligibility, taxes and rules

Whether the goal is to boost retirement savings or reap tax benefits, individual retirement accounts, or IRAs, can offer a range of benefits. However, these benefits can vary significantly based on the type of IRA you choose.

Learning more about the difference between Roth and traditional IRAs when opening an IRA account is key to choosing the best option for your financial situation and retirement goals.

Key takeaways

- Choose a traditional IRA for upfront tax breaks or a Roth IRA for tax-free withdrawals in retirement.

- Roth IRA contributions are limited by income, while traditional IRA deductibility depends on both income and workplace retirement access.

- Roth IRAs offer more flexible withdrawal rules and no required minimum distributions, or RMDs, which can benefit long-term planning and heirs.

Difference between Roth and traditional IRAs

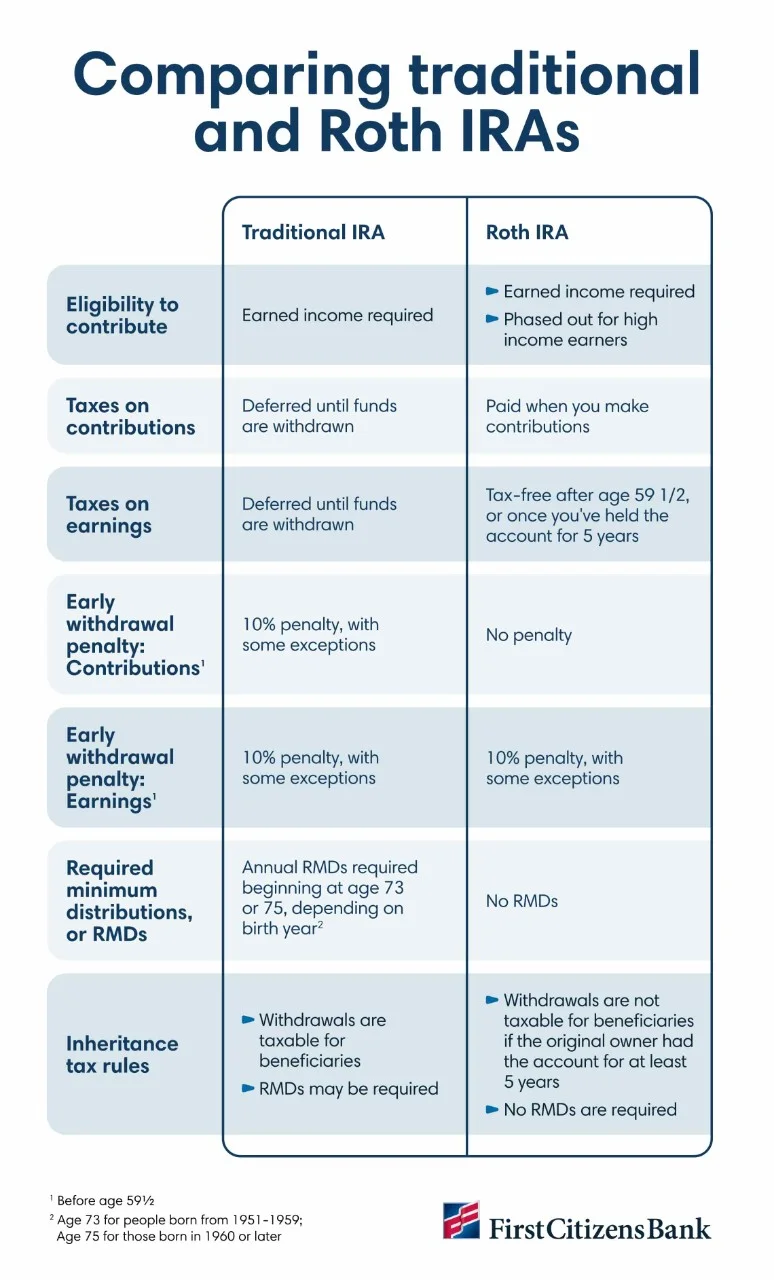

While both types offer a tax-advantaged way to save for retirement, there are important distinctions between the two. Choosing a Roth versus traditional IRA can depend on several key factors, but it all starts with understanding how they differ.

What is a traditional IRA?

A traditional IRA lets you deduct contributions from your income taxes each year, and your money will grow tax-deferred until you take distributions.

- Suitable audiences: Everyone is entitled to contribute to an IRA annually. If you qualify, a traditional IRA lets you deduct contributions from your income taxes each year, and your money will grow tax-deferred until you take distributions.

- Eligibility: Anyone with earned income can contribute, but there are certain limits if you or your spouse has access to a workplace retirement plan.

- Contribution limits: In 2025, IRS rules allow you to contribute up to $7,000 annually if you're younger than 50. If you're 50 or older, you can contribute up to $8,000.

- Taxes: Contributions may be tax-deductible depending on your income and whether you're covered by a workplace retirement plan. Earnings grow tax-deferred. Withdrawals are taxed as ordinary income in retirement. Early withdrawals before age 59 1/2 may incur a 10% penalty and income tax, unless an exception applies.

- Required minimum distributions: You must take required RMDs each year beginning at age 73 or 75, depending on the year you were born.

- Withdrawals: You'll owe a 10% penalty if you withdraw funds before age 59 1/2, although there are some exceptions for penalty-free IRA withdrawals. You pay taxes at your ordinary income rate.

What is a Roth IRA?

A Roth IRA is a retirement account funded with after-tax dollars, meaning contributions aren't tax-deductible. However, your money grows tax-free, and qualified withdrawals in retirement aren't taxed.

- Suitable audiences: Everyone with earned income below the IRS income limits can contribute to a Roth IRA. While contributions aren't tax-deductible, a Roth IRA allows your money to grow tax-free, and qualified withdrawals in retirement are also tax-free.

- Eligibility: Your ability to contribute to a Roth IRA begins to phase out at certain income levels and is prohibited at higher income levels.

- Contribution limits: Roth IRAs share the same contribution limits as traditional IRAs. As of 2025, you can contribute up to $7,000 if you're younger than 50 and up to $8,000 if you're 50 or older.

- Taxes: Contributions are made with after-tax dollars and aren't deductible. Earnings grow tax-free. Qualified withdrawals in retirement are tax-free, though you must be age 59 1/2 and meet the 5-year rule. Contributions—but not earnings—can be withdrawn at any time without taxes or penalties.

- RMDs: There are no RMDs with Roth IRAs, so you can grow your savings tax-free for as long as you want.

- Withdrawals: You can withdraw your contributions at any time, for any reason, without taxes or penalty. However, you won't be able to withdraw any earnings before age 59 1/2 without paying taxes and a penalty. If you're 59 1/2 or older and have owned your account for at least 5 years, you can withdraw your earnings and any converted funds tax-free. You may also be able to withdraw $10,000 for a first-time home purchase.

Choosing between a Roth and traditional IRA

In general, you should consider the following factors when assessing the difference between Roth and traditional IRAs.

1Determine your eligibility

With traditional IRAs, anyone earning income can contribute up to the annual limit. But if you or your spouse has access to a retirement plan at work—even if you don't contribute—your ability to deduct contributions may be limited.

While a Roth IRA doesn't have age limits, eligibility depends greatly on your earnings. While the exact limits change every few years, individuals must earn less than the top threshold established by the federal government in order to make any contributions to a Roth IRA.

In 2025, contributions to a Roth IRA are prohibited if your modified adjusted gross income, or MAGI, exceeds one of the following thresholds:

- $165,000 or more for single or head-of-household filing status

- $246,000 or more for married filing jointly or qualifying widow or widower filing status

- $10,000 or more for married individuals filing separately who lived with their spouse at any time during the year

It's important to note that these Roth and traditional income limits don't apply if you're converting funds from a traditional IRA to a Roth IRA or rolling over a 401(k) to an IRA.

2Choose your tax break

Carefully consider what you think your tax rate may be during retirement. If you expect it to be lower—which is the case for many individuals—a traditional IRA may be the best option. You'll get an upfront tax break now when your tax rate is higher. Once you enter retirement and begin taking withdrawals, you'll pay taxes at a lower rate. This is a common situation for many retirees, who pay the highest taxes during their peak earning years.

However, if you anticipate being in a higher tax bracket in retirement, a Roth IRA may be a better fit. This way, you'll pay taxes on your contributions now at a lower rate and will benefit from tax-free withdrawals in retirement.

Of course, it's not always easy to predict what your future tax situation will be. Both tax laws and your earning power could change substantially, especially if you're a long way from retirement.

3Evaluate withdrawal rules and penalties

With a traditional IRA, you'll owe income tax on withdrawals, plus a 10% penalty on any funds you take out before age 59 1/2. Select circumstances, like a first-time home purchase or qualified withdrawal for higher education, might not incur a penalty fee but could still be taxed. Also, if you still have money in your traditional IRA account by age 73—or age 75 if you were born in 1960 or later—you must begin taking RMDs each year.

With a Roth IRA, withdrawals are more flexible. You can withdraw your original contributions tax- and penalty-free at any time. If you're age 59 1/2 and have held your account for at least 5 years, you can also withdraw your earnings tax- and penalty-free. Roth IRAs aren't subject to RMDs.

Common questions about IRAs

As you calculate how much to save for retirement, you may still have questions about your IRA options. Here are some answers to get you started.

Can you have both a Roth IRA and a traditional IRA?

Yes. You can contribute to a Roth IRA and a traditional IRA during the same year, as long as your total contributions for both don't exceed annual limits.

Can you convert a traditional IRA to a Roth IRA?

Roth conversions are a popular strategy, particularly for those who are retired but haven't started taking RMDs. Be aware that you'll owe income taxes on any funds you convert, so it's wise to consult a qualified tax advisor and financial planner before moving funds.

What are the best investments for a Roth versus traditional IRA?

With both accounts, you'll have the freedom to choose from many types of IRA investments like stocks, bonds and mutual funds. A Roth IRA may be a tax haven for growth-oriented investments, but it's a good idea to talk to a financial advisor before making any investment decisions.

The bottom line

Both traditional and Roth IRAs can be essential investment tools—whether you're using them as part of a self-employed retirement plan, want to supplement an employer-sponsored plan or simply wish to reap the tax benefits.

The easiest way to choose between a Roth versus traditional IRA is to consider when you'd like to receive your tax benefits. If you're hoping to reduce your tax burden today, a traditional IRA may be the right option. However, if you'd prefer not to worry about taxes later in life, you might benefit from setting up a Roth IRA.

No matter which path you choose, learning more about how IRAs work can help you make the most of your account. As always, it's a good idea to speak with a financial advisor or tax professional before making any decisions.

Ready to get started?

Understand your options so you can make the most of retirement planning.