What to look for when buying long-term care coverage

When Kelly Sullivan talks to clients about long-term care coverage, she asks them to imagine a future in which day-to-day activities they take for granted now—things like bathing, eating, showering, using the bathroom, and getting in and out of bed—don't come so easily.

Understanding the costs

"It's not if something is going to happen, but when," says Sullivan, Manager of Life Insurance Sales for First Citizens Investor Services. "If I'm sitting with a couple, there's a 70% chance that one of them will need long-term care of some type."

That care could come in the form of at-home nurse visits, or it could be offered in an assisted living facility or nursing home. According to the 2021 Genworth Cost of Care Survey, the median monthly cost for an in-home health aide is $5,148. The median monthly cost for an assisted living facility is $4,500, and it costs an average of $9,034 per month for a private room in a nursing home.

"If there is no plan, the plan often becomes the adult child," Sullivan notes. "But let's say your adult children live across the country. If you don't have long-term care insurance, what is your plan B? What asset are you going to sell first to pay for your care?"

These are hard questions, but people's answers—or lack thereof—help them understand the importance of preparing for potential future healthcare costs. Because paying for long-term care coverage requires a holistic financial approach, consider the following factors when you do your homework.

Hybrid policies offer flexibility

Long-term care is usually defined as the support and services people need to perform six activities of daily living, ranging from bathing to moving around their homes. Long-term care can be provided for short or long periods.

Today, the long-term care insurance landscape is much different than it was a decade ago, Sullivan notes. That's important for people to understand, as many potential buyers who need long-term care insurance are hesitant after they witnessed their parents struggle to pay increasing premiums on their policies.

"I don't think the industry realized 20 to 25 years ago that people would keep their policies as they have," Sullivan explains. "Insurance companies initially priced policies assuming that more people would allow their policies to lapse, but that didn't happen." On top of that, people were living longer. "To keep up, insurance companies raised premiums."

Fortunately, the conditions that led to those increases aren't a concern across the majority of policies sold today.

Two things have happened in the long-term care insurance market. First, policies are priced more appropriately, so there's a reduced likelihood of premiums going up. Second, as a result of changing market conditions and consumer demand, older use-it-or-lose-it types of policies have mostly been replaced by hybrid policies, also called asset-based policies.

These hybrid models require the owner to pay a single premium. If you need long-term care, it's covered, and if you don't, it works somewhat like a permanent life insurance policy because your money goes to the beneficiary of your choice. This way, your legacy goals remain intact if you don't need to use your money for long-term care.

A supplement to Medicare and Medicaid

It's easy to lump long-term care insurance and health insurance into the same category. In reality, Sullivan explains, long-term care insurance and health insurance serve different purposes.

Long-term care insurance pays for custodial care, which is non-medical care provided by professional caregivers. In other words, it pays for help if you need it to perform one or more of the six activities of daily living, such as bathing, dressing or using the bathroom.

"Most people prefer to have these activities occur in their homes, rather than in a hospital—especially when you consider that long-term care helps with cognitive diseases like Alzheimer's and dementia," Sullivan says.

Custodial care usually isn't covered under Medicare. And while Medicaid will cover some long-term care expenses for low-income recipients, those recipients often have to spend the bulk of their assets before they qualify for help.

Alternatives to stand-alone long-term care coverage

When clients apply for long-term care insurance, they undergo a lengthy phone interview where the insurer tries to get a feel for the applicant's cognitive strength, as well as their health history.

"Remember that the older you get, the more health history you'll have—and some of that history may keep you from qualifying," Sullivan says.

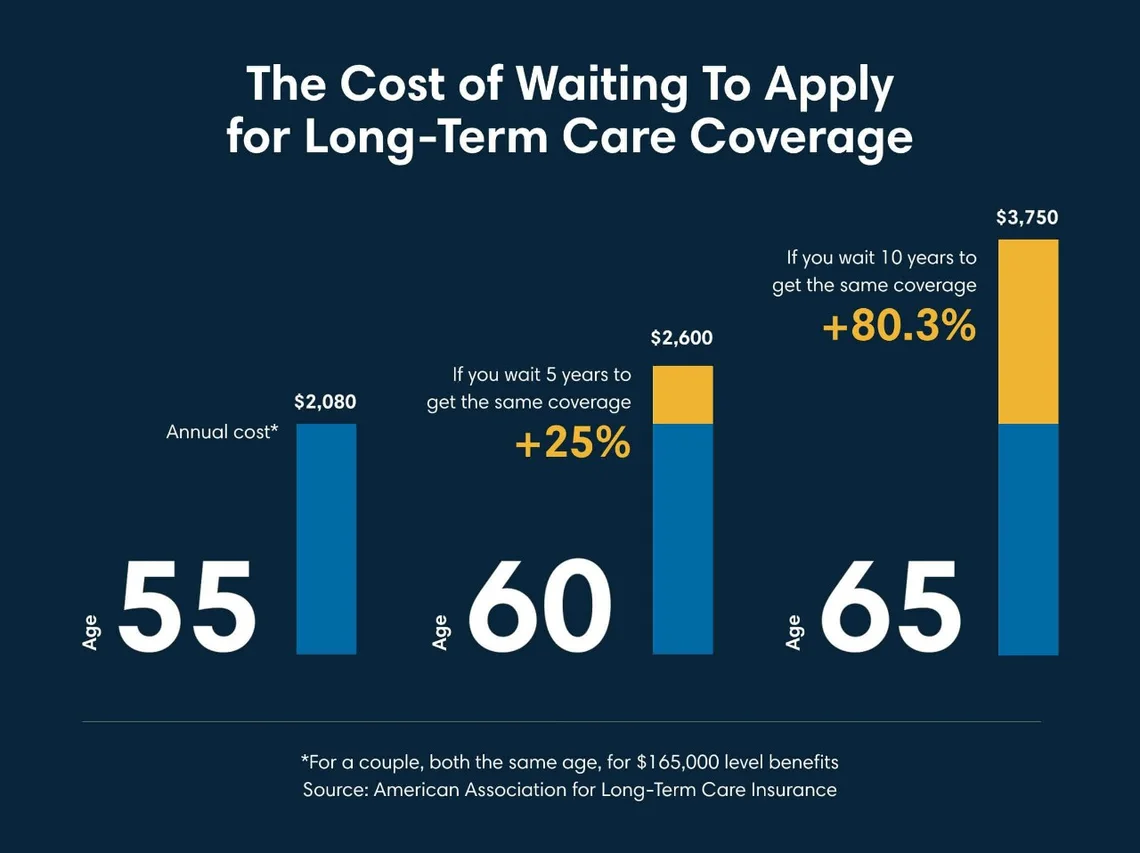

Even though long-term care insurance is more affordable the younger you are, it can be hard to prioritize alongside competing financial goals, such as saving for retirement and paying for life insurance.

For younger clients in their 40s or early 50s, Sullivan suggests considering life insurance policies with long-term care riders. "It's super inexpensive to add a rider, so if you need long-term care 40 years from now, you will have paid for it over the years."

How much long-term care coverage do you need?

Statistically speaking, most people end up purchasing long-term care insurance because they either don't have the assets to pay for that type of expense out of pocket or they choose to offset the cost of care. "Generally, we think that if you have $500,000 in assets you could comfortably put toward your long-term care if needed, then you can self-insure," Sullivan says.

Because most people aren't in that category, long-term care insurance offers the best solution. Be sure to talk with a knowledgeable insurance agent and a financial advisor, who can help you match your need for long-term care with the equally important goals of keeping your retirement savings intact and leaving your legacy goals in place.

Communicate your plans and desires to family members

Sullivan urges her clients to speak with their parents about their plans for long-term care, if any—and to put those plans in writing.

"That is so important because if someone suffers from cognitive decline, it gets a little sticky," she notes. "Be sure to have any appropriate power of attorney documents in place for parents or grandparents. Then the adult child can more easily access funds to put their parents' plan into place."