State of the Cannabis Industry report 2025

In our inaugural State of the Cannabis Industry report, we examined the key trends affecting today's cannabis businesses. The purpose of this report was to provide business owners and operators with valuable insights to navigate this industry's challenges and opportunities.

Key takeaways

The majority of the cannabis businesses we surveyed reported strong to very strong financial health, with expectations of significant sales growth in the next 12 months. Growth in 2024 may have required more grit than in years past, but it continued at substantial levels.

1Company growth will be primarily driven via three distinct strategies

Cannabis companies taking part in our survey reported that the bulk of their growth will come from market expansion, product diversification and strategic alliances. Plant-touching businesses will focus on product diversification, while non-plant-touching companies plan to prioritize partnerships.

2Securing basic banking services is still a significant challenge

Survey participants share their experiences with all-cash operations and alternative loans. The rates and terms of these options continue to hamper growth. First Citizens remains committed to addressing this challenge as the cannabis industry continues to evolve.

3Increased corporate investment in legislative affairs

Of surveyed participants, 41% reported investing in lobbyists or government affairs personnel to advance legislation that will support their business interests. Involvement in cannabis trade organizations is another area where businesses are finding value, though only 1/3 are currently taking part.

Most businesses are optimistic

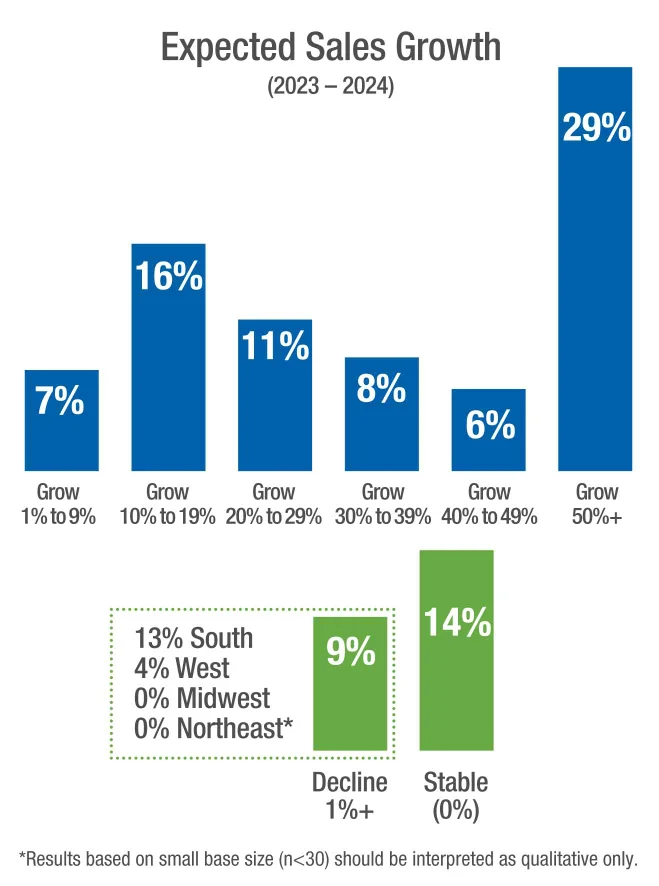

The survey revealed that 77% of cannabis businesses anticipated year-over-year-sales growth. Average expected sales growth was 38%, although businesses operating in the South were more likely to expect sales declines.

Sales growth expectations

State of the Cannabis Industry report 2025 available now

Download the State of the Cannabis Industry report to read at your convenience.