Business Accounts Payable Services

Streamline payables processes, expenses and transactions

ACH Payments

Deposit funds to employee and customer accounts safe and conveniently.

Real-Time Payments

Make payments in seconds, easily and securely.

Controlled Disbursement

Accurately forecast your daily cash requirements.

Purchasing Card

Simplify business purchases, reduce paperwork and monitor expenses with the First Citizens Visa® Purchasing Card.

Wire Transfers

Move funds fast—domestically or internationally.

Let us guide you to the right accounts payable service

What does your current business health look like?

Manage your business on the go

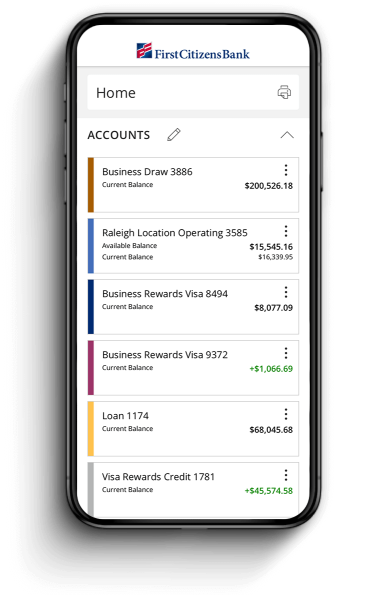

Manage your accounts from anywhere

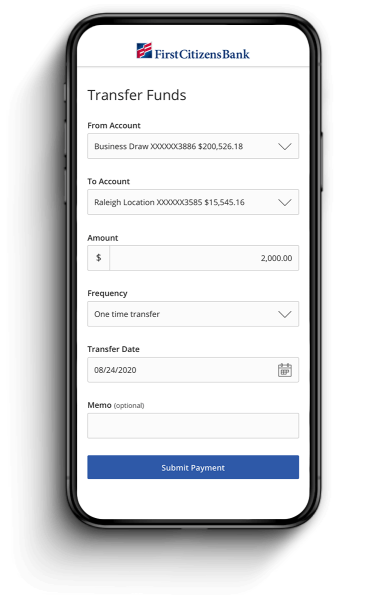

Send & transfer money with ACH and wires

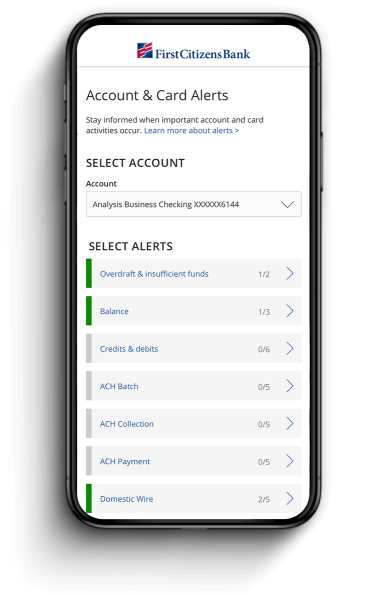

Receive account and security alerts