The Four Cornerstones for Staying Invested

Brent Ciliano CFA | SVP, Chief Investment Officer

Phillip Neuhart SVP | Director of Market and Economic Research

Blake Taylor VP, Market and Economic Research Analyst

In an unpredictable financial landscape, market swings can be overwhelming and lead investors to question their long-term investment allocation. But history shows that staying invested despite market volatility is essential.

Here are four reasons to stay invested during a volatile market.

1Market timing is a dangerous game

We're often asked, "Should I move to cash until the market rebounds?" To make gains through market timing, investors must get it right twice—first to sell before the market downturn, and then to reinvest before the market begins to recover.

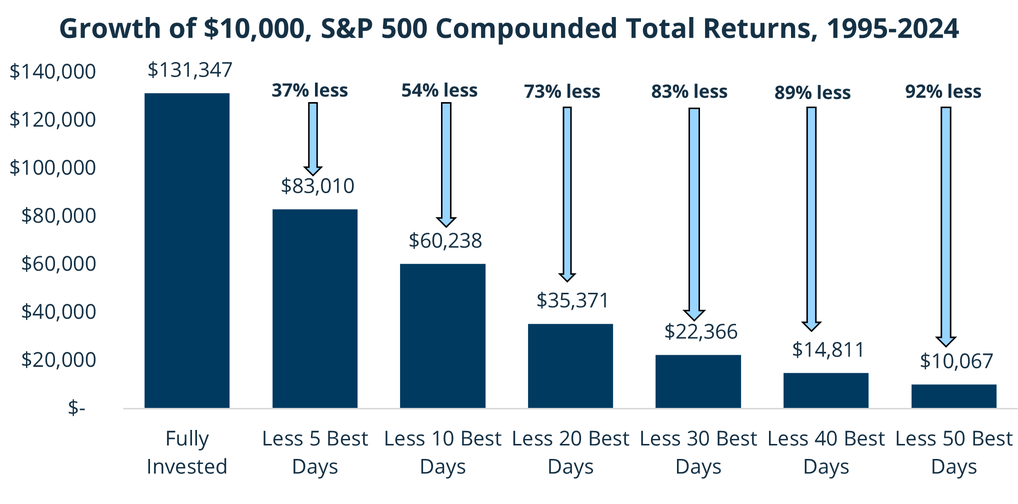

The latter may be the most detrimental, especially during times of extreme volatility. Missing even just 5 of the S&P 500's best days proves costly. While attempting to avoid sharp declines during volatility, it's unfortunately all too common for investors to miss the early days of the subsequent rally.

For some concrete data points, consider that 48% of the S&P 500 Index's strongest days occurred during a bear market. Another 28% of the market's best days took place in the first 2 months of a bull market—before it was clear that a bull market had begun.

A combined 76% of the S&P 500's best days occurred when investors wouldn't likely have wanted to be in the market. April 9, 2025, is a recent example. The market rallied 9.5% in the midst of tariff turmoil, representing the 10th largest gain in the S&P 500 since at least 1928.

Missing even a few of the best market days can be costly

2The S&P 500 has recovered fairly quickly after most drawdowns

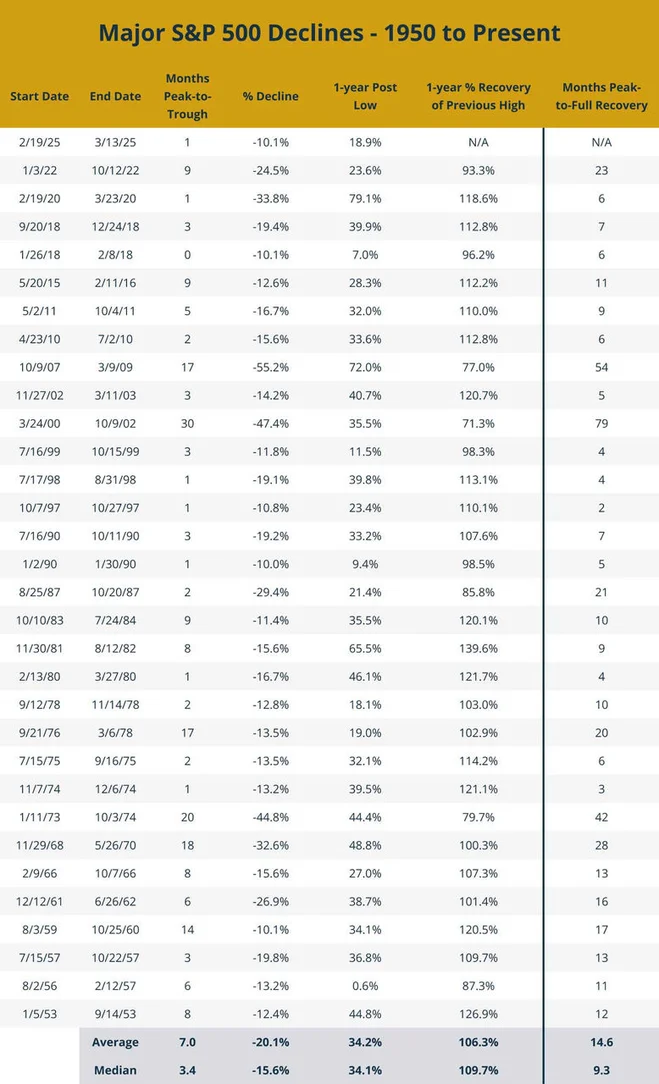

When reviewing market drawdowns of 10% or greater since World War II, in both recessionary and nonrecessionary circumstances the average duration of a drawdown lasted less than 10 months. On average, investors regained more than 100% of losses 1 year after the bottom of the drawdown.

Let's put the current market volatility into recent historical perspective. As of the time of this writing, the S&P 500's peak drawdown since the February 19 all-time high was 18.9%. Markets have recently recovered from these lows.

We don't yet know if the market has achieved its cycle low, but that's the point—it's difficult to time short-term equity market moves. History shows that while it may take some time, the stock market eventually recovers to its previous highs.

Time to full recovery for >10% drawdowns, recessionary and non-recessionary

3Returns during and after a recession

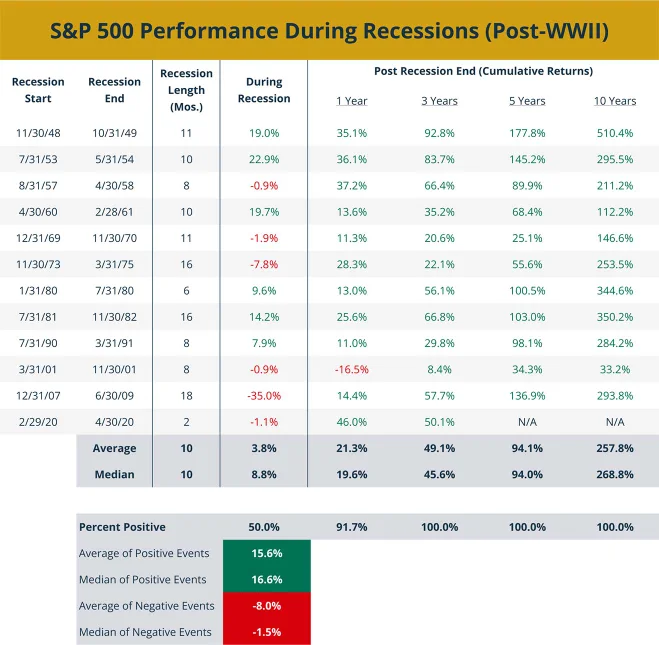

We're not calling for an imminent recession in our base case. However, many investors are concerned that the probability has risen since earlier this year. It's important to keep in mind that recessions are a strong indicator of forward returns in the months and years following.

On average, 1, 3, 5 and 10 years post-recession, the S&P 500 has posted positive cumulative returns 92%, 100%, 100%, and 100% of the time, respectively. Even during a recession, market returns are a coin flip between positive and negative returns. So while a market recession is certainly hard going, returns are historically greener on the other side.

Performance 1, 3, 5 and 10 years post-recessions

4The best of timing versus the worst of timing

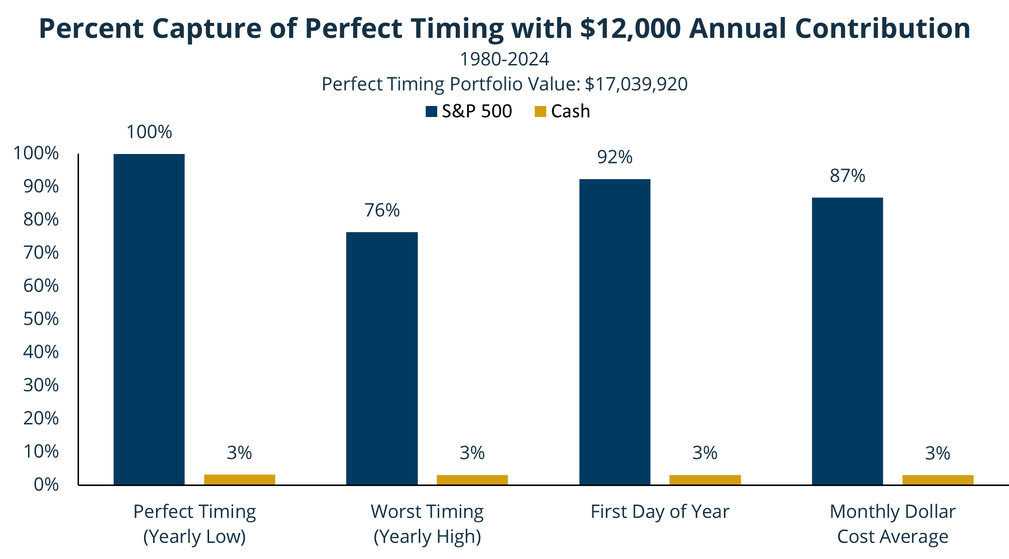

Despite the temptation to wait for an opportunity to enter markets, putting cash to work increases the likelihood of investor success. Inversely, remaining on the sidelines can leave investors behind.

Whether you have the best timing, worst timing or something in between, it's all about the importance of simply time in the markets. If a market participant invested $12,000 each year from 1980 through 2024 and somehow had perfect timing—or bought every year at the yearly low—they would have generated over $17 million, thanks to compounded returns.

Most investors fear the worst timing or buying at the market high every year. Even if that were the case, investors still capture 76% of perfect timing. If an investor simply bought on the first day of the year or monthly dollar-cost averaged at $1,000 per month, they would have captured 92% and 87% of perfect timing, respectively.

The price of the sidelines

The bottom line

In times of uncertainty and volatility, the importance of a long-term, balanced approach to investing and the essential nature of a financial plan remain paramount.