Exploring the benefits of private investments

Over the past few decades, private investments have transitioned from a niche option to a key component of more sophisticated investment portfolios.

According to McKinsey & Company, global private capital assets under management reached $13 trillion in 2023, up 20% per year from 2018. For qualified clients with a tolerance for illiquidity, private investments present opportunities to amplify returns while maintaining comparable risk levels to public investments.

The benefits of private investments

Private investments differ from public investments in several ways, including the types of opportunities available, the level of access to information and how they're managed. Understanding these distinctions can help highlight the specific benefits private investments can bring to a portfolio, especially as part of a diversification strategy.

1The number of private companies is increasing

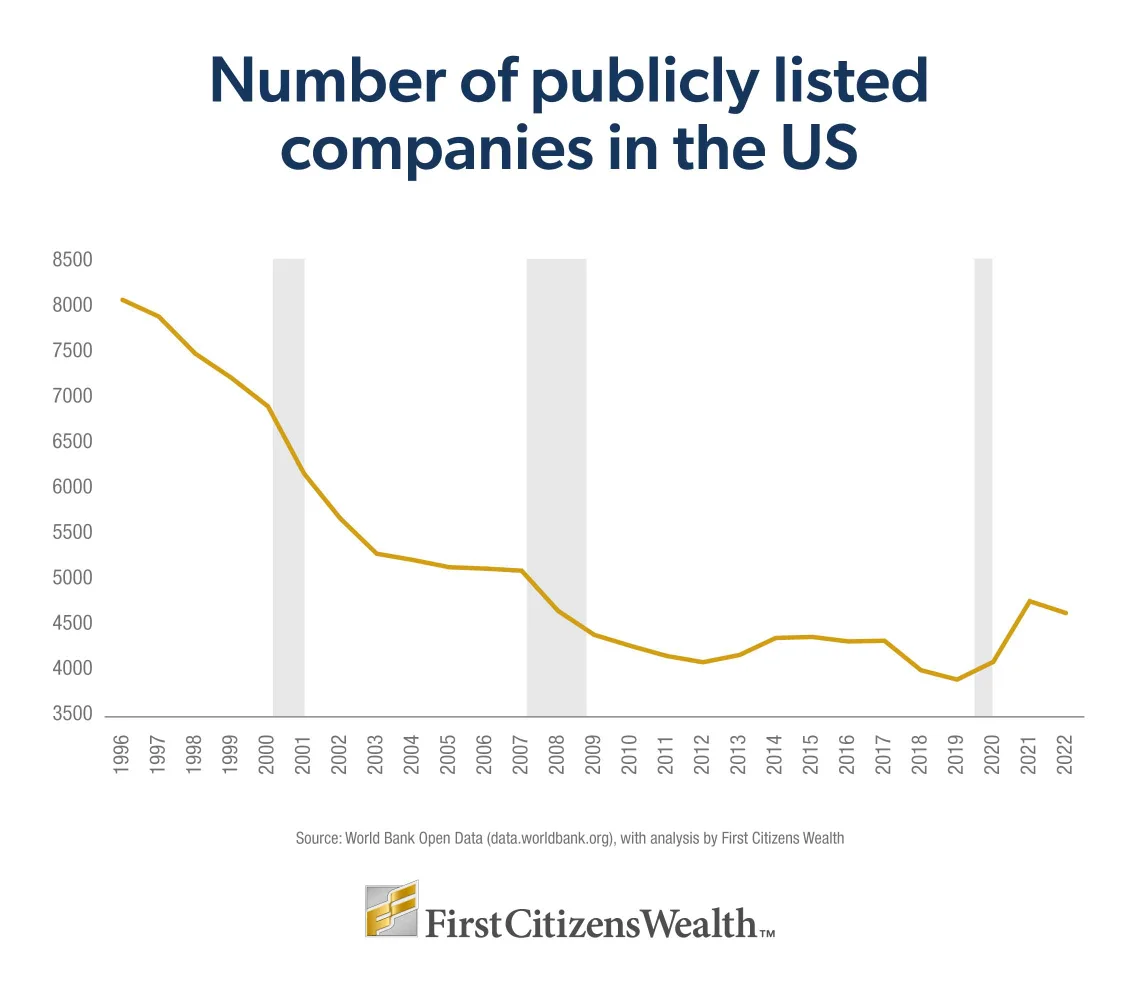

In the US, the number of publicly held companies has been steadily declining while privately held company numbers have grown. Based on data gathered by the First Citizens Wealth investment team in 2023, over 80% of revenue generating companies in the US are privately held.

The decline in publicly held companies is largely due to consolidation, where a small number of companies drive market performance. While public companies remain an essential part of a diversified portfolio, private investments provide additional options for those looking to broaden their approach.

2Private investments can provide stability and resilience

Private investments often have lower correlation to public market events, which can make them less volatile during periods of market turbulence. Public markets are highly liquid—meaning assets can be quickly bought and sold—but this liquidity also makes them more sensitive to economic conditions, market cycles and investor sentiment. This, in effect, leads to significant price swings.

On the other hand, private investments are less liquid because they typically involve a multiyear commitment and can't be traded. While this illiquidity involves careful planning, it can also act as a buffer against short-term fluctuations in value, offering more stability over time. For investors who want a particularly resilient portfolio, private investments may complement traditional market exposure.

3Specialist investors are at the helm of private investments

Private investors are often guided by fund managers and general partners, or GPs, who bring specialized expertise to their asset niches. These GPs typically have deep industry experience and hands-on knowledge, allowing them to identify and assess opportunities that may be challenging for outside investors to evaluate.

This expertise is especially valuable in private markets, where transparency is limited. Private companies aren't always subject to the same regulatory oversight or disclosure requirements as public companies, making it harder to access detailed information. However, GPs often mitigate this lack of transparency by directly engaging with company management or securing board seats, giving them unique access to data and insights that drive informed decision-making.

4Private investments can diversify your portfolio and spread risk

Private investments can complement traditional investments by offering opportunities across a range of asset classes. Each asset class has unique characteristics and risks, making it important to carefully balance your portfolio to align with your financial goals and risk tolerance.

At First Citizens, we believe in multi-asset diversification through verticals such as private equity, real assets and private credit, as well as layering in horizontal diversification through time series allocating to private investments.

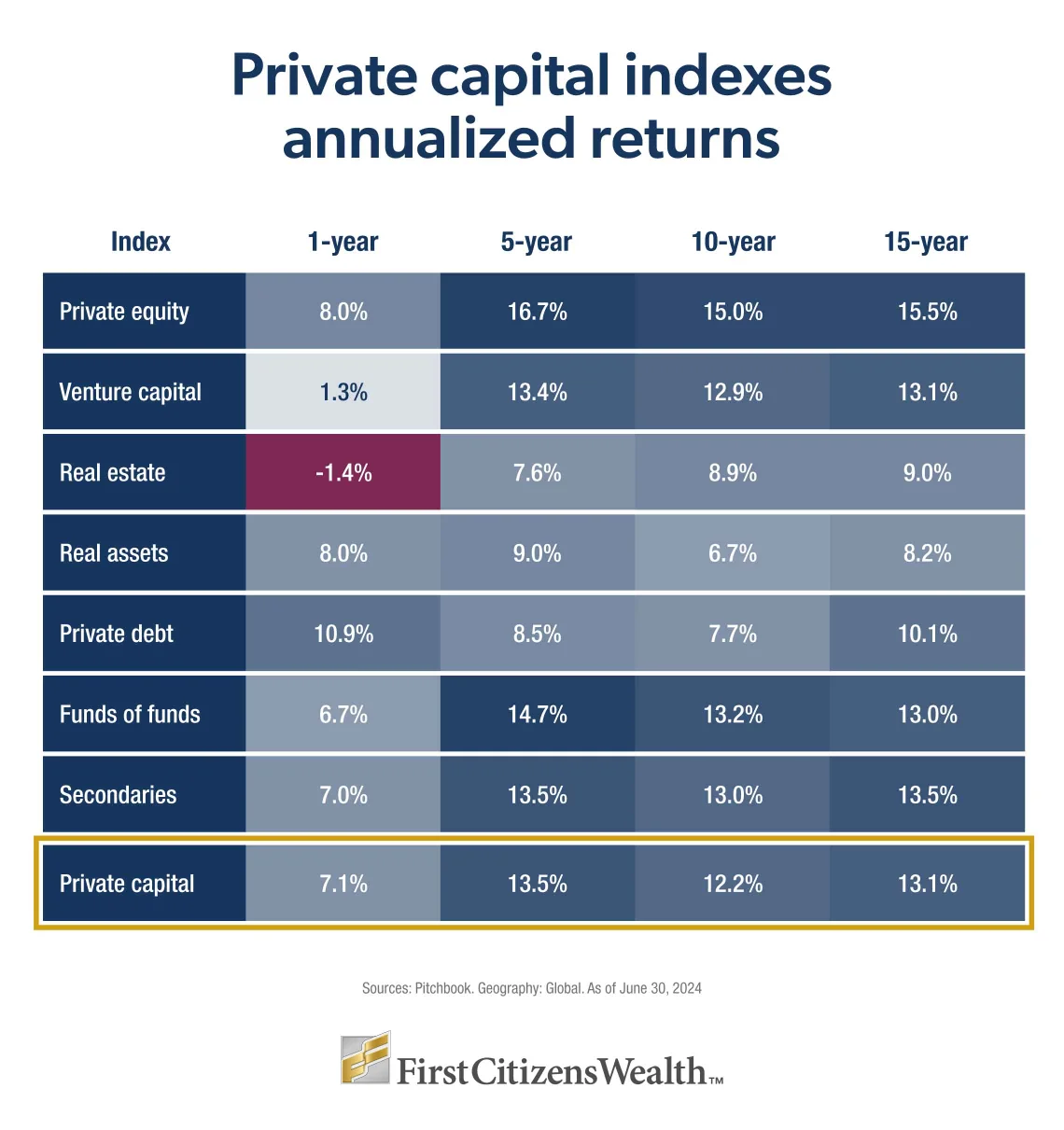

The indexes below highlight several examples of private investment options with historical performances.

What are the categories of private investments?

Private investments span a wide range of asset classes. Understanding these categories is a key step to identifying the level of risk exposure you're comfortable with weighed against the benefits.

Here's an overview of common private investment categories.

- Private equity: These investments are either minority or majority ownership stakes in small- to large-sized private businesses that aren't publicly traded.

- Infrastructure: Funds finance public assets like transportation or utilities, often backed by government agencies. These investments are generally less correlated to public markets and can provide stable, long-term cash flows, which may appeal to more risk-adverse investors.

- Real estate: Funds finance and develop operating properties or lend debt to real estate projects. This category can provide a tangible asset and steady income streams from rents or property appreciation.

- Private credit: Funds extend privately negotiated loans to companies with custom terms to protect the lender. Private credit offers potential higher returns compared to public debt markets but may involve higher risk and complexity.

Leveraging these categories helps investors diversify across multiple private asset classes, spreading risk and improving their portfolios' overall resilience to various economic conditions. A thoughtful approach to understanding these options can help align your investments with your broader financial interests and goals.

The bottom line

The growing accessibility of private investments has contributed to their increasing popularity among investors. With their potential for performance and resilience against short-term market fluctuations, private investments can serve as a valuable addition to a well-diversified portfolio.

For more tailored advice and to determine if private investments align with your financial goals, speak to an experienced First Citizens Wealth consultant. Together, you can evaluate their role in your portfolio and determine the options that best fit your needs.