As interest rates rise, high-yield savings accounts regain appeal

Thanks to continued inflation and rising interest rates, an increasing number of investors are once again eyeing high-yield bank accounts as viable options to hold cash—the most conservative side of a diversified investment portfolio.

Why? Because the highest-yielding accounts can offer significant payouts along with the security of FDIC insurance for the first time in more than a decade.

Upward pressure on interest rates

For the first time since April 2022, when the Federal Reserve started putting upward pressure on interest rates to attack inflation, the national interest rates that banks charge to lend money to each other jumped more than sevenfold.

By July 2023, the upward pressure on rates had pushed the savings national rate cap—which the Federal Reserve imposes on banks it considers less than well-capitalized to keep them from bidding rates too high—to 5.83%. This is an indication that there are significant market pressures on banks to pay much higher rates than in years past to attract deposits away from their competitors.

Of course, while high rates may be attractive for the first time since the financial crisis of 2009, there are other factors to consider when you shop for a place to store cash.

First Citizens Bank Premier Relationship Banker Robin Miller and Premier Client Solutions Sales Manager Daniel Williams share their thoughts on how high-yield accounts are staging a comeback as money makers and how they can best work for you.

Increased returns and consistent safety

"I get calls every day about deposits, which just wasn't the case a couple of years ago," Miller says. "After the markets dipped and the Federal Reserve raised interest rates, people began talking about deposit rates like they used to talk about lending rates."

"Rising rates of returns are just one side of the growing popularity of deposits, though," Williams notes. Certain underlying features that ensure greater security across every class of deposit have been equally important amid economic turbulence.

- Deposits are FDIC insured up to $250,000 per depositor for each account ownership category.

- They typically have set rates of return, minimizing the risk of loss.

- Even when operating under certain restrictions, their higher liquidity makes accessing money and avoiding withdrawal penalties easier.

Know your options

Before taking advantage of rising rates and the security of deposits, Miller and Williams recommend understanding the most common types of high-yield accounts, as well as their benefits.

Money market accounts offer liquidity

Because of their low risk, high liquidity and competitive returns, one of the most popular types of deposit accounts is a money market account. In addition to providing a higher rate of return than traditional savings accounts, money market accounts supply easy access to funds and check-writing capabilities that can help when unforeseen expenses arise.

High-yield savings accounts offer higher rates

Similar to money market accounts, high-yield savings accounts offer a higher interest rate than traditional savings accounts. While they may not have the same check-writing capabilities as money market accounts, high-yield savings accounts make up for it with greater flexibility, access to funds, and lower minimum deposit and balance thresholds.

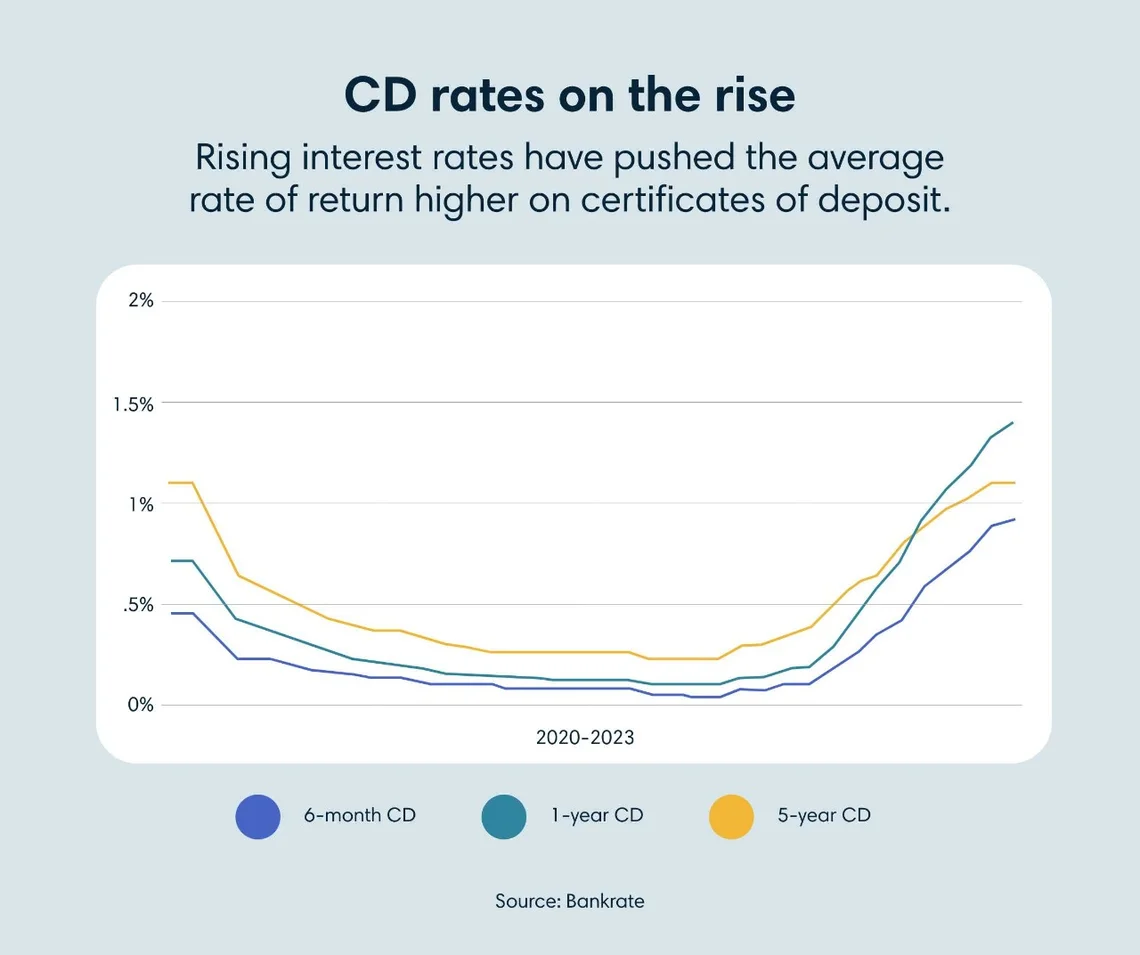

Certificates of deposit on the rise

Rising rates have pushed the average rate of return higher on certificates of deposit, or CDs, with rates on 6-month CDs rising from less than 0.5% to a little less than 1% from 2020 to 2023, according to Bankrate. Rates on 1-year CDs rose from about 0.75% to nearly 1.5% in the same period, while rates on 5-year CDs dropped from a little more than 1% to about the same rate over the 3-year span.

Despite their higher-than-average yields and greater liquidity, one of the drawbacks of money market and high-yield savings accounts is that their rates can fluctuate. With CDs, this isn't the case. For investors who want to take advantage of rising interest rates and are willing to sacrifice liquidity and potentially higher yields to achieve a fixed rate of return, CDs are a simple and straightforward way to further minimize risk. You can lock funds into terms as short as 3 months to 5 years.

Market-linked CDs

With returns determined by their participation rate within an index like the S&P 500, market-linked CDs are a hybrid investment option that offers a combination of the FDIC-insured stability of traditional CDs and the potential for higher returns based on market performance. Typically, their return will be based on the performance of a common index, such as the S&P 500. There's no risk to principal if the CD is held to maturity, but there's a risk of penalties for early withdrawal.

Determine what works best for you

Miller and Williams emphasize three key factors when examining your deposit options: access to funds, risk tolerance and your time horizons on investing goals.

Businesses with enough money to take care of any financial hiccups for a quarter might not have a time horizon that allows for a 5-year CD. However, if they put excess funds into a CD with a 3-month term, they're allowing for a safe profit with only a slight liquidity restriction.

It can also engage in CD laddering, which involves investing in multiple CDs with different maturity levels to maximize returns without having to tie all the funds to the maturity date of a single CD.

"For retirees who have required minimum distributions to take out of an IRA, putting that money into a market-linked CD might be a good way to provide a higher yield on interest income that helps keep inflation from eating into your buying power," says Williams. But it all depends on your liquidity needs and risk tolerance.

No matter what your situation, understanding how these three factors fit into your finances is important.

"The primary reason to invest in deposits isn't because they're currently high-yield accounts, but because they're secure," Miller says.

Looking for a high-rate CD?

Our 11-month CD offers our highest rate to date, and you can start saving by applying online.