Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

If you've fallen behind on your retirement contributions, you're not alone. In fact, 53% of Americans say they haven't saved enough, according to a CNBC poll. If you're just beginning your career, a good rule of thumb is to save 15% of your pretax income for retirement, starting in your mid-20s continuing into your mid-60s.

Once you're beyond your 20s, catching up on your retirement contributions may seem daunting, but it’s certainly achievable. Whether you're a little behind or have no retirement savings at all, there's no time like the present to take charge of your future. Here are some strategies to help you catch up on retirement savings at any age.

Getting an early start on retirement savings can have a significant impact on your financial future. However, if you've just entered the workforce, saving the recommended 15% of your pretax income can be tough. That said, there are a few simple ways to start saving for retirement in your 20s while balancing a modest income and necessary expenses.

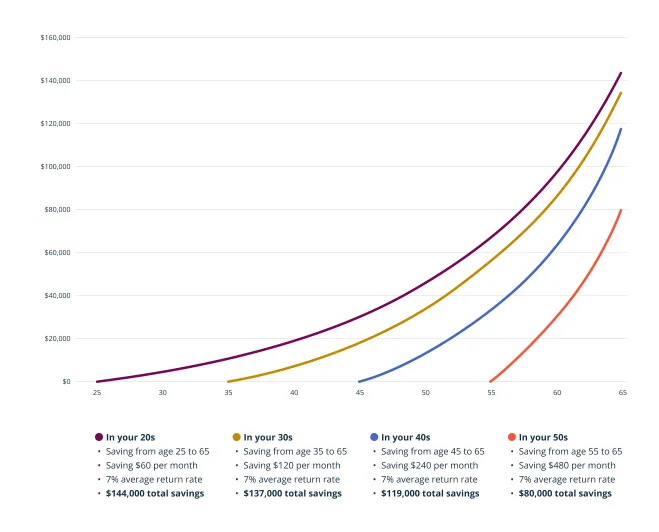

Even small contributions made during your 20s can have a sizable impact over time. For example, if you were to invest just $60 per month in a qualified retirement plan such as an employer-sponsored 401(k) plan starting at age 25 and earn a 7% average annual rate of return—which is the historical average for long-term investments in the stock market after adjusting for inflation—you'd have roughly $144,000 at age 65. If your employer were to match 50% of your retirement contributions to the 401(k) for the duration of this period, your savings could grow to $215,621.

In your 20s, you have a longer time to ride out market fluctuations. As a result, it might make sense to be more aggressive with your investment strategy. Depending on your risk tolerance, you may consider allocating a larger share of your investments to assets like stocks. While they tend to fluctuate more, they often outperform other asset classes over the long term.

By the time you reach your 30s, your income may have increased, along with your financial obligations. There are several key milestones that may eat into your savings during this time, from getting married to raising children to buying your first home. And like many Americans, you may still be chipping away at your student loans.

While this can make it tricky to prioritize saving for the future, it's important to contribute what you can. The good news is you still have time to reap the benefits of compounded earnings and long-term appreciation.

An important lesson to learn is that it isn't all-or-nothing proposition—you don’t have to focus on paying off debt until it's done and then turn your attention to building your savings. You do a little bit of both, like a balancing act. The key is to look for ways to amplify your actions, however small, such as employer matching for paying down student loans or contributing to a health savings account, or HSA. You also want to prioritize saving in tax-preferred vehicles first over fully taxable vehicles.

Here are some tactics to help you catch up on retirement savings in your 30s.

While retirement may still seem far off, setting a target now is essential. Not only will it help you make informed decisions about your finances, but it may also keep you motivated and on track during the years to come—especially if you're overwhelmed by debt. A retirement savings calculator can help you determine how much you'll need to save based on your expected retirement age and future income needs.

Once you have a goal in mind, you'll need a plan to achieve it. A simple retirement savings plan can address how much you need to save each month and the most effective way to do so. Prioritize setting your savings plan first so that all other spending decisions, such as the size of the mortgage you obtain or the type of car you purchase, are bordered by the spending limits you set after your savings plan was created.

Automating your contributions can make it easier to maximize retirement savings. Some employer-sponsored plans may also allow you to set a percentage of your salary for retirement contributions. This will automatically increase your contributions whenever you receive a raise. Check with your plan administrator to confirm how your contributions are determined.

If you're wondering how to boost retirement savings, start by taking full advantage of employer contributions if they're available. Employer matching is essentially free money that can significantly boost your retirement savings over time, making it a great way to maximize retirement savings at any age.

Now that you're more established in your career, you might have a greater sense of financial stability—and a bit more disposable income as well. If you didn't save much in your 20s and 30s, it's time to kick your retirement contributions into high gear, particularly as you're in your peak earning years. While your runway to retirement may be a bit shorter than it once was, you still have a few decades to grow your savings.

Here are a few ways to catch up on retirement savings in your 40s.

If you're maxing out contributions to your 401(k) or primary retirement savings plan, it may be time to consider opening an individual retirement account, or IRA. Traditional IRAs are available to anyone who has earned taxable income during the year. Plus, they offer robust tax benefits and a wide range of investment options. This makes them a powerful tool for anyone hoping to catch up on retirement savings.

As you enter your prime earning years, lifestyle creep can quickly take hold. As your income increases, spending on nonessential items like high-end renovations and upgraded cars tends to rise proportionally—often without being aware of it.

One easy way to boost your retirement savings in your 40s is to look for ways to cut unnecessary expenses and redirect these funds into your retirement account. Small changes won't significantly reduce your quality of life, but they can still pack a punch when it comes to your savings. For example, investing an extra $200 a month at a 7% average annual return could add nearly $100,000 more to your retirement nest egg over the next 20 years.

Your 50s are an important time to buckle down and ensure you're well prepared for retirement. While your salary may be at an all-time high, you could be facing new—and potentially unexpected—financial burdens.

Here are some tips for catching up on retirement savings in your 50s.

The IRS allows individuals ages 50 and older to make additional contributions to their 401(k), IRA and other retirement plans. Known as catch-up contributions, these exceed standard retirement plan contribution limits, making them a great way to maximize your retirement savings in your 50s and beyond. You can find charts outlining both annual contribution limits and catch-up contributions for most types of retirement accounts at IRS.gov.

If you're already maxing out contributions to your primary retirement plans, there are still several avenues you can explore, such as:

The best options for you will depend on a range of factors. Discussing these strategies with a financial advisor can help you decide which course of action will be the most effective at your life stage.

According to the Pew Research Center, 36% of Americans in their 50s are financially supporting a child while also caring for an elderly parent. For many, this can significantly impact their ability to save for retirement. If you're struggling with dueling financial obligations, consider speaking with an advisor. They can aid you in creating a plan that helps you prioritize your future while meeting your current financial obligations.

With retirement on the horizon, many people struggle with how to catch up on retirement savings in their 60s. However, there are a few strategies that may help you maximize savings during this time.

During the ages of 60 through 63, you now have the opportunity to make additional $10,000 annual contributions to your retirement account under the SECURE 2.0 Act. These larger catch-up amounts are in addition to the catch-up amounts made available when you reach your 50s.

As you continue to take full advantage of catch-up contributions, be sure to reassess your risk tolerance. Look for ways to defend your existing retirement savings against market volatility while still generating income. For some, this might mean moving investments to more conservative options.

If necessary, consider working a few extra years to give your savings more time to grow. For example, you might step back from your full-time job but continue to earn extra income through consulting work. This can help boost your retirement savings while also reducing the number of years you'll need to rely on those funds.

If your home has appreciated over the years or you've upgraded homes throughout your life, downsizing to a smaller home can free up equity you can use to help fund your retirement. As you approach retirement, you'll likely have less of a need for a large home and the associated upkeep. Transitioning to a smaller living space can give you access to your existing home equity, reduce ongoing expenses and may even inspire you to simplify your lifestyle.

If you're in a lower tax bracket now than you expect to be in retirement, you may want to consider converting some of your retirement savings to a Roth IRA. Although you'll be hit with an immediate tax bill on the conversion amount, the funds will continue to grow tax-free within the Roth account. Plus, qualified withdrawals in retirement will also be tax-free. Be sure to consult with a tax specialist to see if a Roth conversion is right for you.

As you get closer to retirement, it's a good idea to seek the support of a financial advisor. They can help you create a thorough plan based on your lifestyle needs and projected healthcare expenses. If you're falling short of your savings goals, they can help you determine how to catch up on retirement savings.

Only have a minute or two? Watch our video to get a quick summary of strategies and techniques to help you save more for retirement throughout your career.

Retirement looks different for everyone. That's why you need a savings plan that fits your unique needs. Whether you're retired, nearing retirement or just starting out, we'll help you develop a strategy that covers it all.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.