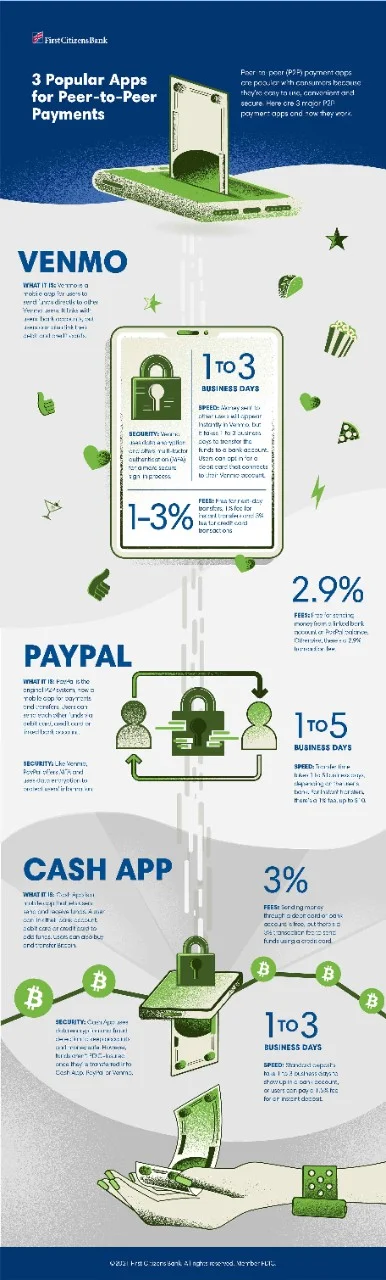

3 popular apps for peer-to-peer payments

Have you ever used an app for peer-to-peer, or P2P, payments? Apps like Venmo, PayPal and Cash App have attracted millions of users over the last decade. In this infographic, we explore these P2P apps and learn about how they work. You can read a transcript of the information below the infographic.

P2P payment apps are popular with consumers because they're easy to use, convenient and secure. Here are three major P2P payment apps and how they work.

Venmo

- What it is: Venmo is a mobile app for users to send funds directly to other Venmo users. It links with users' bank accounts, but users can also link their debit and credit cards.

- Speed: 1 to 3 business days. Money sent to other users will appear instantly in Venmo, but it takes 1 to 3 business days to transfer the funds to a bank account. Users can opt in for a debit card that connects to their Venmo account.

- Fees: Free for next-day transfers, 1% fee for instant transfers and 3% fee for credit card transactions.

- Security: Venmo uses data encryption and offers multi-factor authentication, or MFA, for a more secure sign-in process. Unfortunately, funds transferred into Venmo aren't FDIC insured.

PayPal

- What it is: PayPal is the original P2P system, now a mobile app for payments and transfers. Users can send each other funds via debit card, credit card or linked bank account.

- Speed: 1 to 5 business days. Transfer time takes 1 to 5 business days, depending on the user's bank. For instant transfers, there's a 1% fee, up to $10.

- Fees: Free for sending money from a linked bank account or PayPal balance. Otherwise, there's a 2.9% transaction fee.

- Security: Like Venmo, PayPal offers MFA and uses data encryption to protect users' information. However, once funds are transferred into PayPal, they aren't FDIC insured.

Cash App

- What it is: Cash App is a mobile app that lets users send and receive funds. A user can link their bank account, debit card or credit card to add funds. Users can also buy and transfer Bitcoin.

- Speed: 1 to 3 business days. Standard deposits take 1 to 3 business days to show up in a bank account, or users can pay a 1.5% fee for an instant deposit.

- Fees: Sending money through a debit card or bank account is free, but there's a 3% transaction fee to send funds using a credit card.

- Security: Cash App uses data encryption and fraud detection to keep accounts and money safe. However, funds aren't FDIC insured once they're transferred into the Cash App.