6 HOA payment options homeowners expect

Making it easier for residents of a homeowners association, or HOA, to pay their HOA fees can go a long way toward reducing late or missed payments. So it's smart for these communities to offer as many safe payment options as possible.

Late or missed payments may strain an HOA's finances, compromising the ability to pay operating expenses and avoid special assessments. Sluggish receivables can also create major friction between neighbors, as board members may have to enforce stricter collections policies. One effective solution to reduce delinquencies is offering residents more flexibility in how they pay.

A shift toward flexible HOA payments

"We're seeing a shift toward younger homebuyers, and they are increasingly accustomed to paying bills electronically," says April Ahrendsen, a Regional Sales Officer for First Citizens.

In fact, nearly 50% of Gen Z and millennials didn't send a single check in 2023, according to one GoBankingRates survey.

"At the same time, many homeowners, especially those in 55+ communities, still prefer more traditional methods like paper checks," adds Nicole Skaro, Vice President and Relationship Sales Officer for First Citizens. "But they may not be aware of the potential delays or security risks associated with mailing checks and having that sensitive information out in the world."

A community association management company can help meet these diverse needs by facilitating various HOA payment methods.

Pros and cons of HOA payment options

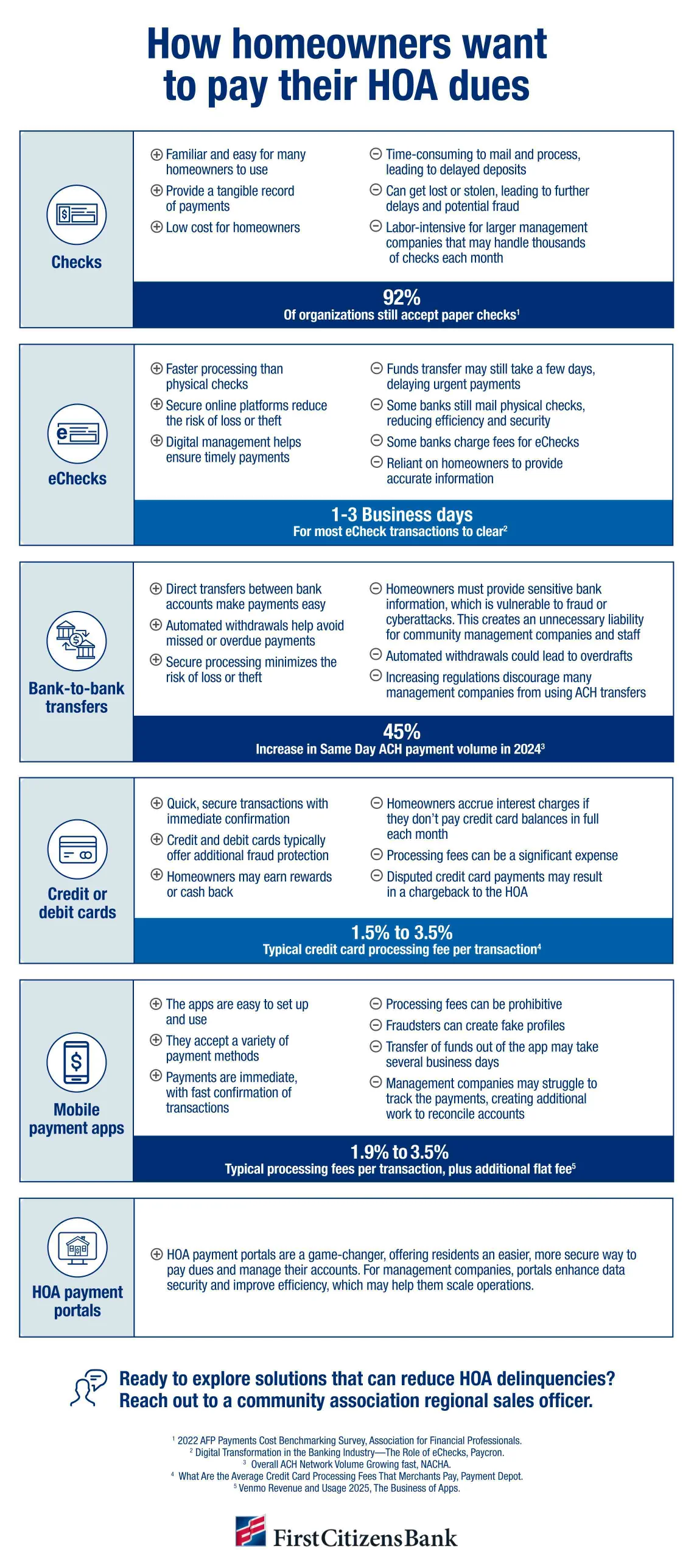

There are six common options to pay HOA fees, each with unique benefits and challenges.

- Checks: Despite the growing popularity of digital payments, most HOAs still accept paper checks, which can be mailed or hand delivered.

- eChecks: Many banks offer online bill pay services, allowing homeowners to set up one-time or recurring payments directly from their checking accounts.

- Bank-to-bank transfers: Residents authorize management companies to withdraw funds directly from their bank accounts using Automated Clearing House, or ACH, transfers.

- Credit or debit cards: Larger management companies may accept credit or debit cards, allowing for one-time or recurring payments.

- Mobile payment apps: Some may accept mobile payment apps like Venmo and Cash App, though these platforms may have significant drawbacks.

- Digital payment portals: Online HOA payment portals allow homeowners to securely pay dues or other assessments, view transaction history and manage their accounts conveniently.

The rise of digital HOA payment portals

To streamline accounts receivables, many management companies are adopting digital payment portals that give residents a secure and convenient way to pay HOA dues or other assessments online. Some companies create proprietary portals, while others partner with banks or software providers.

For instance, First Citizens offers Property Pay for its community association banking clients. Residents log in to a customized portal and choose to pay with eCheck transactions or credit or debit cards. They can even set up free recurring eChecks for added convenience.

Why digital portals matter

One of the key benefits of digital payment portals is operational efficiency.

"Management companies can only manage so many communities if everyone pays via paper checks," explains Christi Wells, First Citizens' Director of Community Association Banking Regional Sales. "With automated systems they can scale effectively."

HOA payment portals also enhance data security. With traditional methods like ACH transfers or paper checks, management companies are responsible for storing sensitive data, such as routing and account numbers. However, with a digital portal such as Property Pay, First Citizens handles this sensitive data, ensuring compliance with advanced security protocols.

Additionally, management companies receive a data report each business day detailing the status of all receivables. Having access to this timely data allows for better decision-making and improved business practices.

The future of HOA payments

Adopting electronic HOA payment methods is becoming increasingly important. Going digital not only streamlines back-office operations but also helps management companies stay competitive by providing greater convenience for residents.

Still, flexibility is key. Providing a range of payment options can help HOAs better meet the needs of their diverse communities, reduce delinquencies and foster positive relationships among residents.

Ready to explore solutions?

If you want to reduce HOA delinquencies, reach out to a community association regional sales officer. They can work with you to ensure your business has the tools and resources it needs to compete effectively.