Investing in the Places We Call Home

We're proud to announce a $16 billion, 5-year Community Benefits Plan that builds on our ongoing work to reinvest in low- and moderate-income (LMI) communities and neighborhoods of color. This plan will help increase our investment in the cities and towns we serve and help grow vibrant and diverse communities and businesses.

Through 2025, our Community Benefits Plan will focus on lending to and investing in LMI neighborhoods with regular input and feedback from a group of community experts.

Our $16 Billion Community Benefits Plan

$6.9 Billion

for Community Development Lending, or CDL, and investments

$3.2 Billion

for mortgage loans

$5.9 Billion

for small business loans

In addition, the plan provides for $50 million Community Reinvestment Act (CRA)-qualified philanthropic giving through 2025.

CRA-Qualified Nonprofit Grant Funding

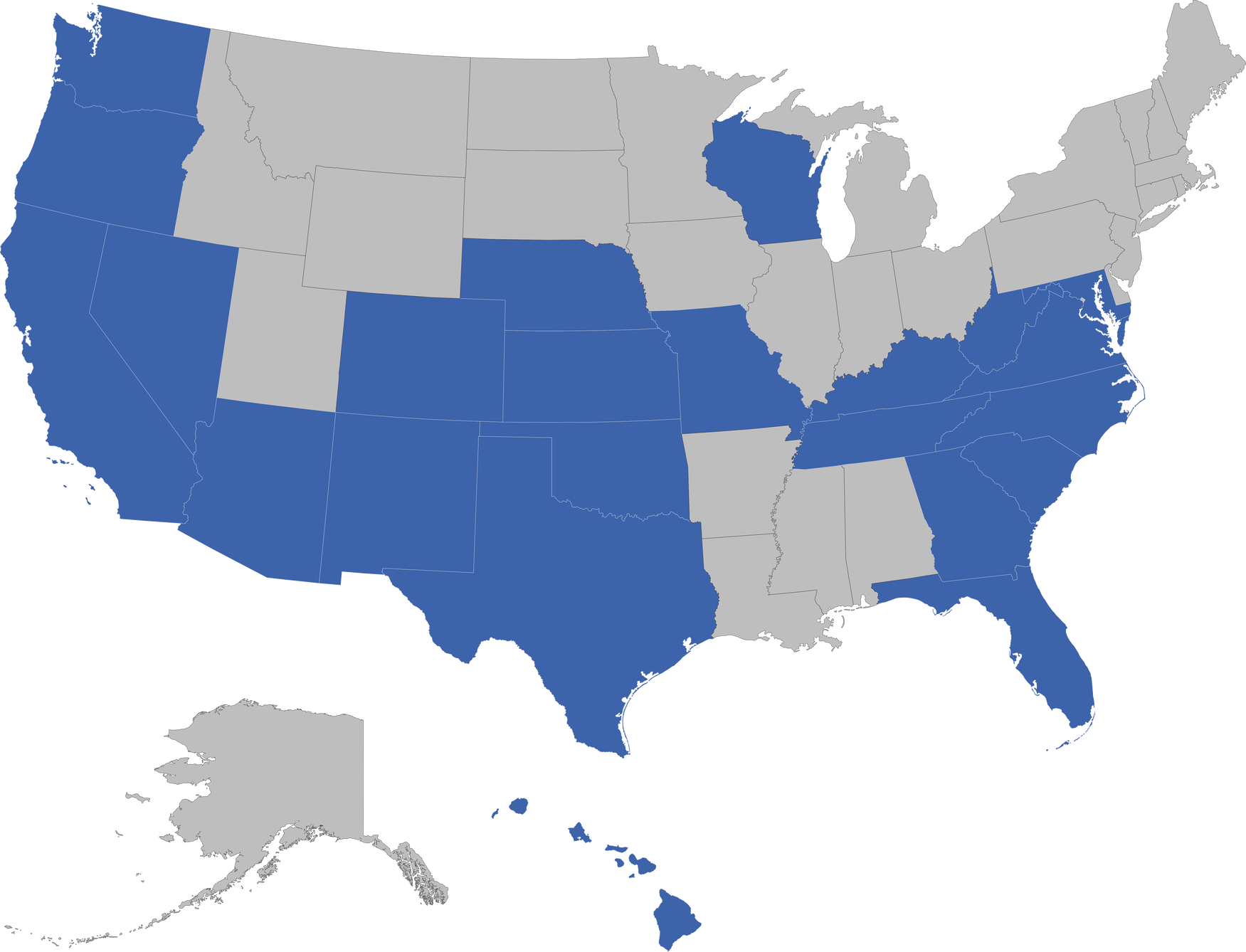

Our goal is to provide lending, investments and services that reflect the needs of our local communities. We accomplish this by increasing our investments and spending in low- to moderate-income communities and through CRA-qualified nonprofit grant funding. We offer CRA-qualified grants to benefit nonprofit organizations that support affordable housing, economic self-sufficiency and business growth in the communities we serve.

About Our Grant Funding

Please make sure you review our funding priorities, grant process and eligibility criteria before submitting a grant funding request.