Summary of service

Commercial Advantage provides the kind of sophisticated cash management capabilities you need to conduct business easier, faster and more efficiently.

Your initial log in

Essentials to know

Over the weekend of July 16 to 17, we arranged for the automatic transfer of:

Beginning Monday, July 18, be sure to complete the following:

Beginning Tuesday, July 19:

For a comprehensive listing of Action Items covering every treasury management product, please visit the Action Items Checklist.

Digital Banking

Commercial Advantage

Accurately track cash flow

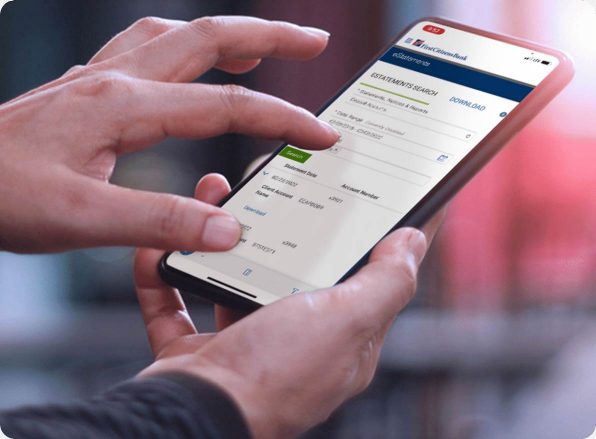

Manage your business on the go

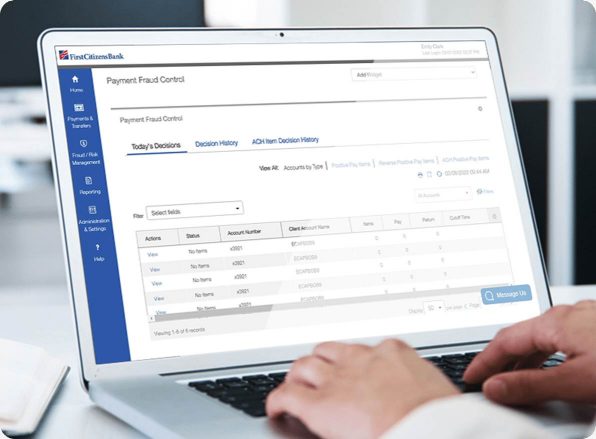

Keep your assets secure

Additional resources

Commercial Advantage Learning Center

Our Learning Center puts all the information about Commercial Advantage at your fingertips.

Action Items Checklist

This helpful resource breaks down all the action items you need to take as you transition to First Citizens, by the services you use.

Profile Manager Quick Reference Guide

Understand how to self-service first name, last name, email address and enrollment factors in Profile Manager.