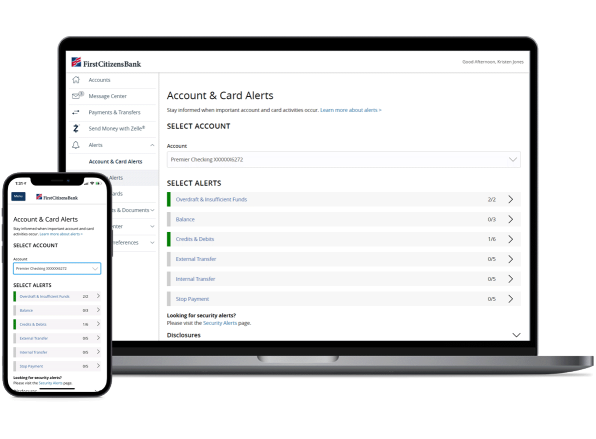

Account and Card Alerts

A quick and easy way to manage your alerts

Keep tabs on your account with alerts

Alerts help you stay on top of your accounts with timely emails, text messages or both. They can be set up for different accounts and cards, adding a crucial layer of security to your finances.

The Account & Card Alerts experience in Digital Banking helps you see which alerts are available and which ones you're currently enrolled in. It makes it easy to edit and update your alerts on the fly so you're always in the know.

How do I enroll?

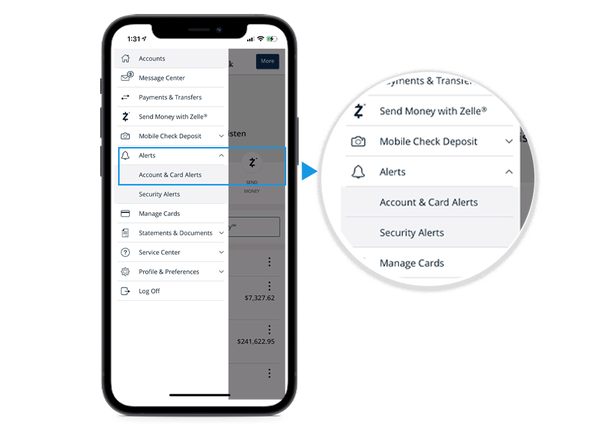

1. Navigate to Alerts in Digital Banking

Account alerts and card alerts are grouped together in the main menu. Just look under Alerts for Account & Card Alerts.

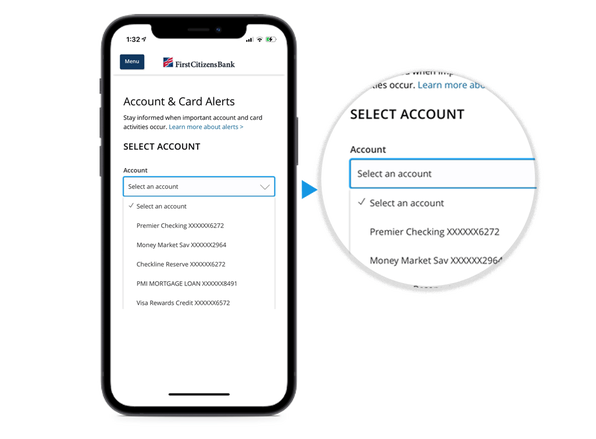

2. Select an account

You can switch between your checking, savings, loan and credit card accounts to manage your alerts. To manage debit card alerts, simply select the account your debit card is linked to.

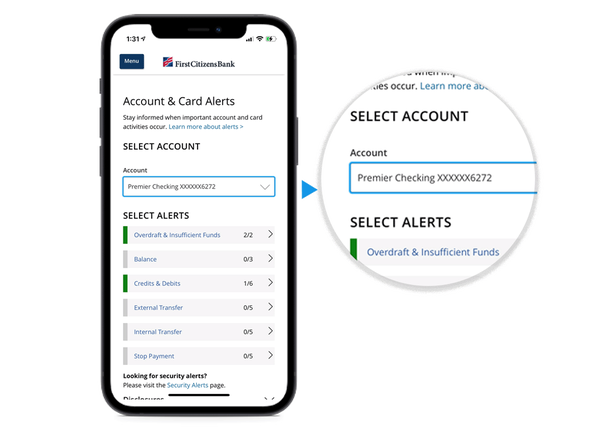

3. Select an alerts category

Once you select an account, available alerts are grouped into categories so it's easier to find, edit and enroll in the alerts you want.

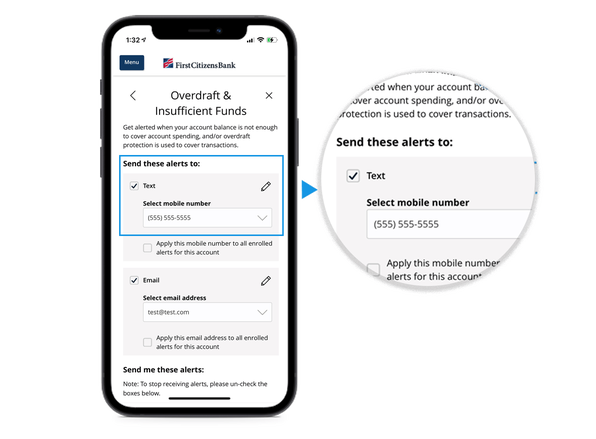

4. Enroll in alerts

You can choose to receive alerts by text, email or both. Simply add or edit the phone number or email address you want to use, then select the alerts you'd like to receive.