What's New

The latest updates to your Digital Banking experience

- Personal

- Small Business

Browse our most recent changes

Keep track of payments the easy way

There's no need to wait for the mail—or fill up your recycling bin. Enroll in e-statements for your Home Equity Line of Credit and other eligible accounts.

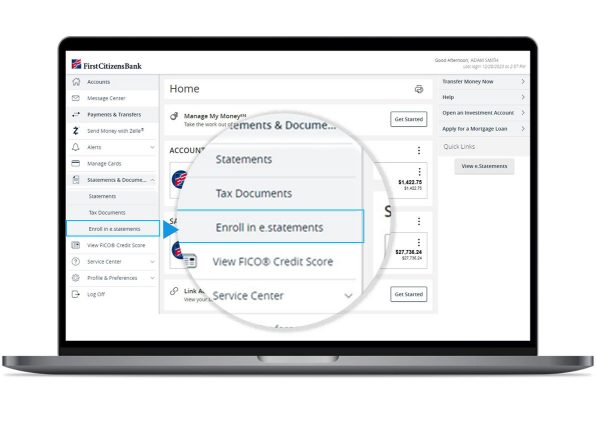

How to enroll in e-statements

- Access the menu button in the top left corner of your Digital Banking account.

- Select Statements & Documents.

- Select Enroll in e.statements.

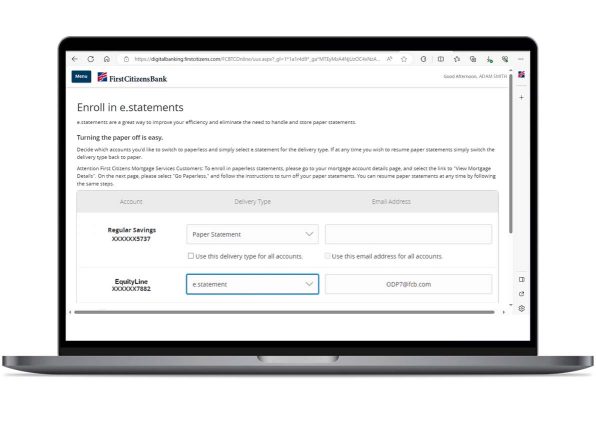

How to choose delivery type

- You'll see a list of your accounts—including your HELOC, if you have one. You can choose e.statements from the Delivery Type drop-down menu associated with any of your accounts.

- To confirm the change, you'll need to verify a keyword from a PDF as a quick security measure.

- Check the box indicating that you've read and agree to the terms and conditions.

- Make sure to select Submit.

- Now you'll see your statements as PDFs in Digital Banking.

Handle fraudulent card activity

It's more important than ever to be aware and on guard for potential fraud and scams.

Be alert

If you suspect you've been a victim of card fraud, don't respond to pressure tactics urging you to take action. Instead, log in to Digital Banking and go to the Manage Cards feature. You can easily toggle the Lock Card to secure your card.

Please note we can't dispute pending transactions. If you have an unauthorized transaction, please monitor your account and call us at 888-FC-DIRECT to dispute any charges that you suspect are fraudulent after they post to your account.

Avoid scams

- Never give personal information to people who may contact you unsolicited by phone, email or otherwise.

- Avoid opening attachments and clicking links within emails or text messages from people or organizations you don't know.

- If it seems too good to be true, it probably is.

- Be wary of information from seemingly legitimate sources that encourage or require you to log in to view information or provide personal identifying information.

- Don't share your login IDs and passwords.

- Use First Citizens Account & Card Alerts to stay informed when important account and card activities occur. Choose to receive alerts to your mobile phone number or email address.

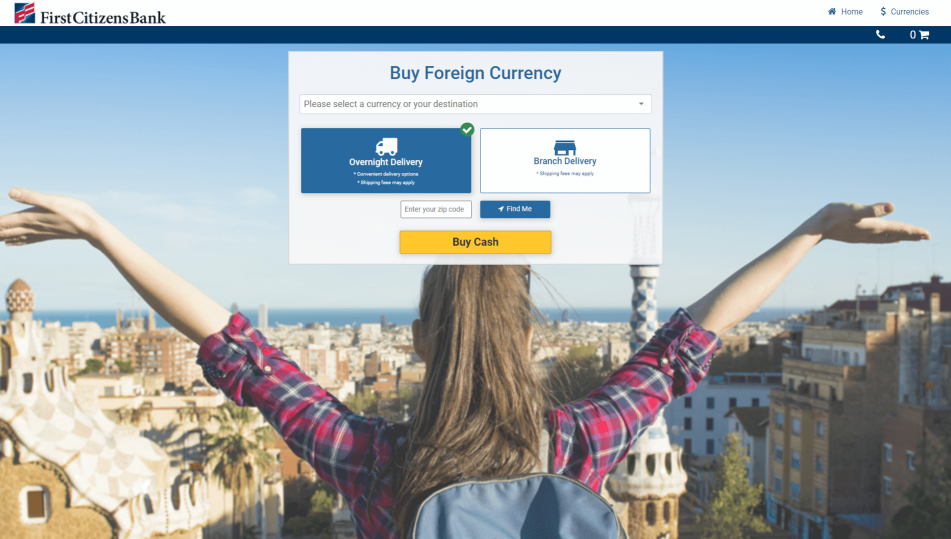

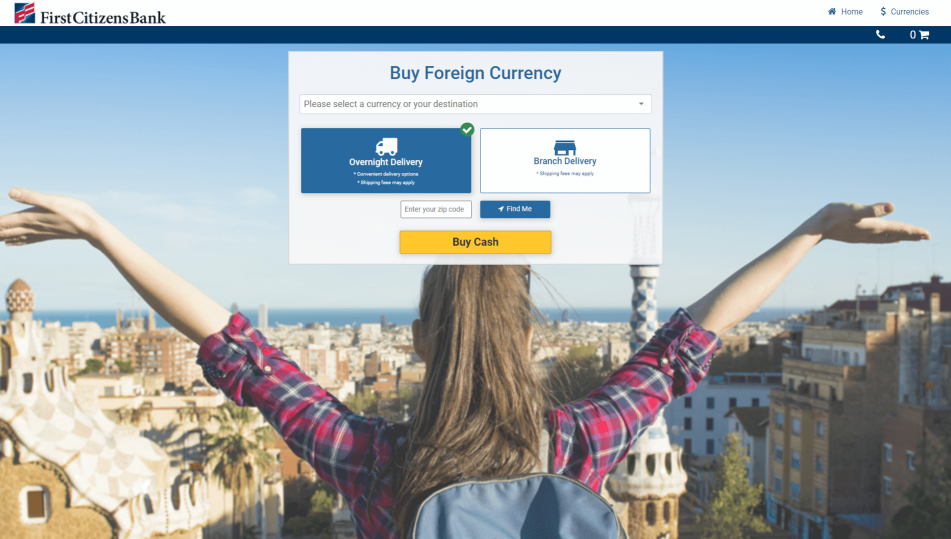

Order foreign currency online in Digital Banking

Planning to travel internationally? Now you can order foreign currency online without having to visit a branch.

Quick and convenient ordering

- Over 90 currencies to choose from

- Order multiple currencies at one time

- Deliver currency to your home or pick it up at a local branch

- Minimum order is $250 with a daily limit of $2,500 online (including home delivery fee of $15)

How to order foreign currency

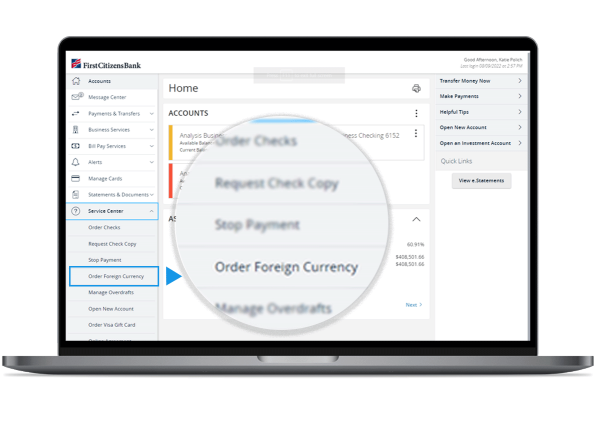

- Log in to Digital Banking and select Order Foreign Currency in the left-hand navigation menu, under Service Center.

- You'll be taken to Currency Exchange International, where you can select from a list of currencies and place an order for home delivery or local branch pickup.

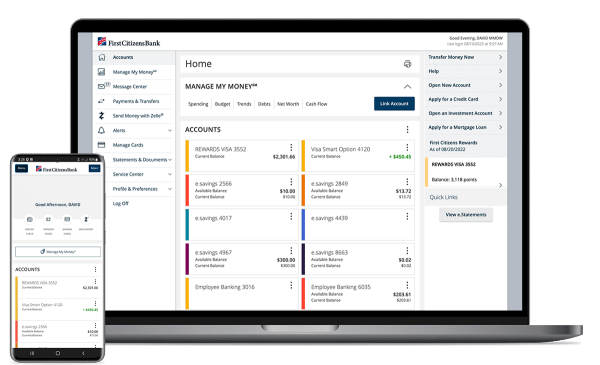

Introducing a quick and easy way to check your balances

Make spending decisions on the go with Quick Balance, now available in your First Citizens Digital Banking mobile app. With Quick Balance, you can check your account balances from the login page without having to log in.

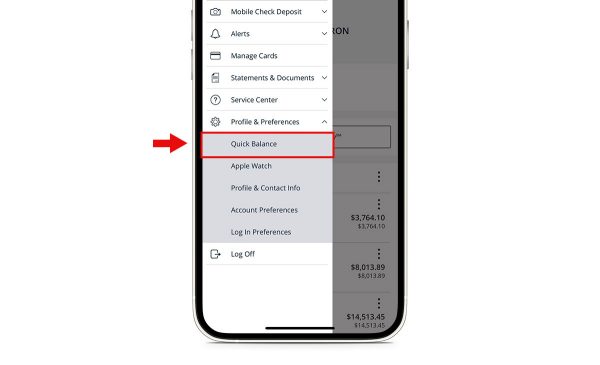

Where to find Quick Balance

Quick Balance is located in the mobile menu under Profile & Preferences.

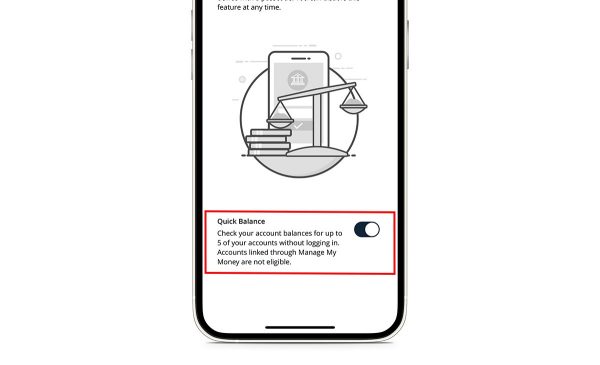

How to enable Quick Balance

To turn Quick Balance on or off, simply toggle the switch on the settings screen.

What it looks like

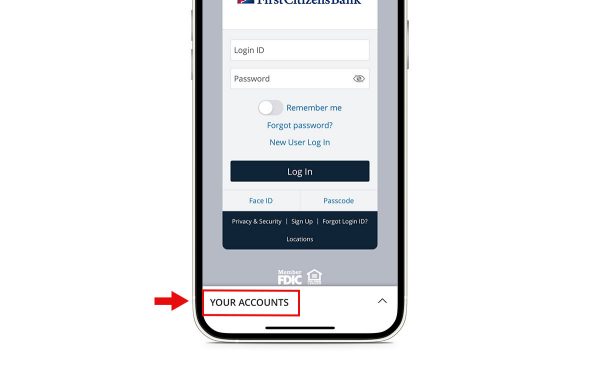

After you turn on Quick Balance in your mobile app and log out, you'll see Your Accounts at the bottom of the login page.

How to use Quick Balance

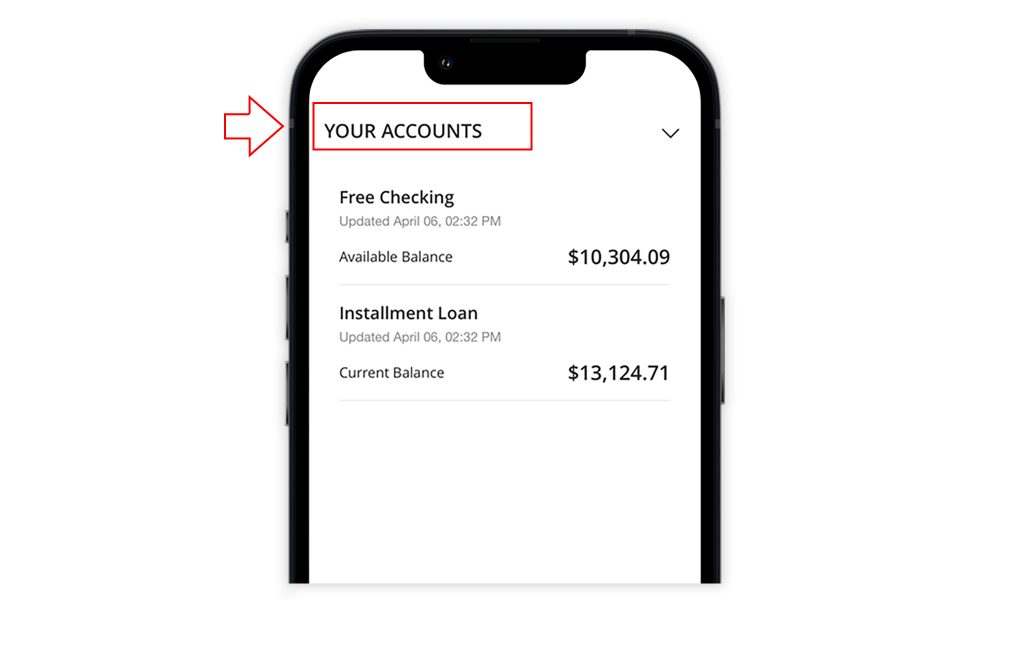

Select Your Accounts to view balances for the first five accounts listed in your account summary.

A few things to know about using Quick Balance:

- Quick Balance won't show hidden accounts or external accounts linked through Manage My Money℠.

- Your last login method will continue to display each time you open the app. For example, if you have Face ID® enabled but want to use Quick Balance, you'll have to cancel the Face ID authentication to select Your Accounts.

- If you'd like to perform other activities beyond checking your balances, such as transferring money, you'll need to log in.

Delivery login preferences security announcement

Your security is our priority. That's why we need you to add or update your phone number in your secure delivery login preferences.

Industry trends reflect an increase in the number of compromised email addresses. First Citizens is taking steps to mitigate the risk by eliminating email as an option for your Secure Access Code (SAC).

A SAC is used whenever a new or unknown device or browser is used to log in to your accounts. This code has to be entered before your account can be accessed. Currently, the SAC can be sent via mobile text message, voice phone call or email address. Going forward, we're removing email as a delivery option, and you can only get a SAC via text message or phone call.

We strongly encourage you to add a mobile number to receive your SAC via text message. To add a mobile or voice delivery option, please go to Profile and Preferences > Login Preferences > Secure Delivery.

If you have questions, we're happy to help. Send us a secure message within Digital Banking, and a representative from our Customer Care Center will be in touch.

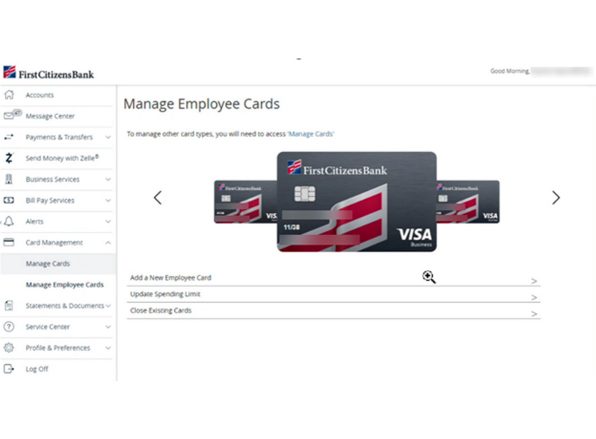

Start managing employee credit cards online

Need to manage your employees' credit cards? Businesses can now add and close employee credit cards online, as well as adjust credit card spending limits, without having to visit a branch or speak with a service representative.

Note: Managing employee debit cards is unavailable at this time.

How to manage employee credit cards

- Getting started: To manage employee credit cards, select Manage Employee Cards from the Card Management menu within Digital Banking for business. This will display eligible credit cards in a carousel.

- Eligibility: The Manage Employee Cards tile will display for all Digital Banking for business users but will only work for users that have Enable Manage Employee Cards rights activated. You'll receive a pop-up notification letting you know if you don't have an eligible card.

- Managing user entitlements: To manage entitlements for your users, log in to Digital Banking for business, navigate to Manage Users under the Business Services tab and select the user whose rights you'd like to edit. Click the user to Assign Rights, then go to the Features tab and select to either enable or disable Enable Manage Employee Cards.

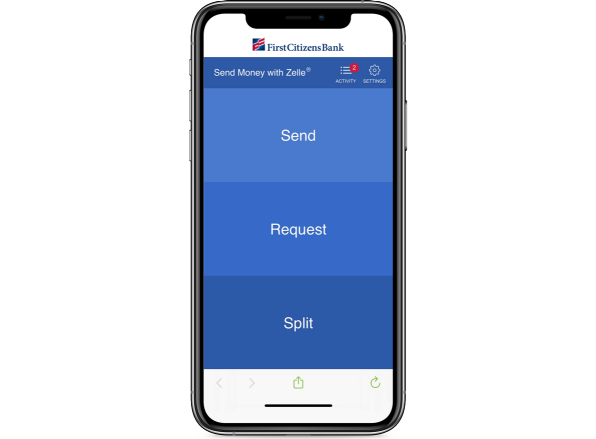

Zelle® lets you send and receive payments—fast

As a Digital Banking for business customer, you can now use Zelle® to send, request and receive payments from your customers.D

A fast, easy way to get paid

Your customers can pay you with Zelle® right from their banking app, so you can receive payments on the go and skip the trip to the bank. Receive money by sharing just your email address or US mobile number with your customer.

It's simple to start sending and receiving money with Zelle®.

- Log in to Digital Banking and select Send Money with Zelle®.

- Enter your email address or US mobile phone number.

- Receive a one-time verification code.

- Enter it, and accept the terms and conditions.

Order foreign currency online in Digital Banking

Planning to travel internationally? Now you can order foreign currency online without having to visit a branch.

Quick and convenient ordering

- More than 90 currencies to choose from

- Order multiple currencies at one time

- Deliver currency to your home or pick it up at a local branch

- Minimum order is $250 with a daily limit of $2,500 online (including a $15 home delivery fee)

How to order foreign currency

- Log in to Digital Banking and select Order Foreign Currency in the left-hand navigation menu, under Service Center.

- You'll be taken to Currency Exchange International, where you can select from a list of currencies and place an order for home delivery or local branch pickup.

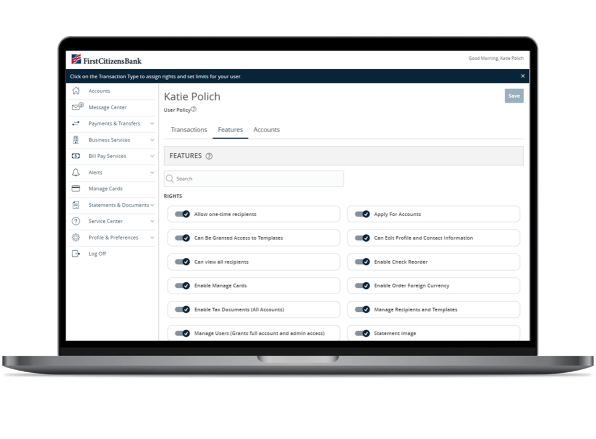

How to manage your sub-users' rights to order foreign currency

- Log in to Digital Banking and select Manage Users in the left-hand navigation menu, under Business Services.

- Select the user to edit and click Assign Rights.

- Toggle Enable Order Foreign Currency under the Features tab to enable or disable.

Note: The Order Foreign Currency right will be automatically enabled for all business groups and sub-users of that business group that have Manage Users access. The right will be disabled for sub-users who don't have Manage Users access.

Delivery login preferences security enhancement

Your security is our priority. That's why we need you to add or update your phone number in your secure delivery login preferences.

Industry trends reflect an increase in the number of compromised email addresses. First Citizens is taking steps to mitigate this risk by eliminating email as an option for your Secure Access Code, or SAC.

A SAC is used whenever a new or unknown device or browser is used to log in to your account. This code must be entered before your account can be accessed. Currently, the SAC can be sent via mobile text message, voice phone call or email address. Going forward, we're removing email as a delivery option, and you can only get a SAC via text message or phone call.

We strongly encourage you to add a mobile number to receive your SAC via text message. To add a mobile or voice delivery option, please go to Profile and Preferences > Login Preferences > Secure Delivery within your account.

If you have questions, we're happy to help. Send us a secure message within Digital Banking and a representative from our Customer Care Center will be in touch.

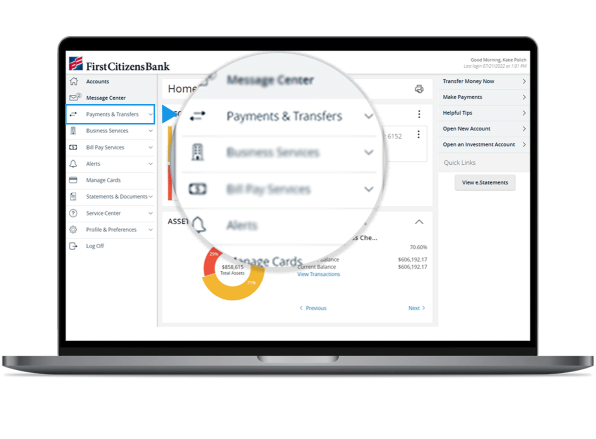

A new way to make payments

Digital Banking for business users will see changes to their left navigation rail under the Payments & Transfers menu. These changes impact how you set up and manage recurring payment activity for your First Citizens loans and credit cards.

- Manage Online Activity has been redesigned to show recent funds transfers and mobile deposits only.

- Pay Loan or Credit Card now supports the setup of recurring payments.

- Recurring Payments is where you can manage recurring payments to loans and credit cards.

- Payment Activity shows your recent loan and credit card payment activity.