Tax-Saving Strategies to Consider in 2023

Paying taxes is a certainty. But the amount you need to pay is far from set in stone.

With foresight, planning and creative strategizing in mind, you can take steps now that will save you money when the tax deadline arrives. To help you consider ways to reduce your tax bill, we've brought in Walt Reed, Director of Trust and Estate Tax at First Citizens Wealth Management, to provide foundational tax-saving strategies that could help set you up to pay less in the coming year—no matter what your situation.

Four strategies to help you save on your taxes

1 Forecast, defer and accelerate

There's one fundamental action on which tax-saving strategies are built—forecasting. That means understanding your finances and potential tax burdens ahead of April. "Knowing where you stand in the second half of the year is essential to identifying tax advantages," says Reed. "Forecasting your income out from midyear to December 31 gives you one or two quarters to make any changes to get your income and deductions in order and handle tax liabilities."

Reed cautions against projecting your income too early. Waiting until midyear enables a more accurate projection because it ensures at least half of your calculations are founded on solid figures. It also helps you see if your income is on track with start-of-year projections on which you may have based your initial tax strategy.

"Should your income look like it will be higher than your start-of-year estimate, you'll be in the best position to defer income and accelerate deductions," says Reed. "If you can defer locked-in income until next year, it will ease your tax liability. If you can accelerate tax-deductible expenses that you know you'll need in the coming year, you can write those off in conjunction with the tax benefits from deferrals."

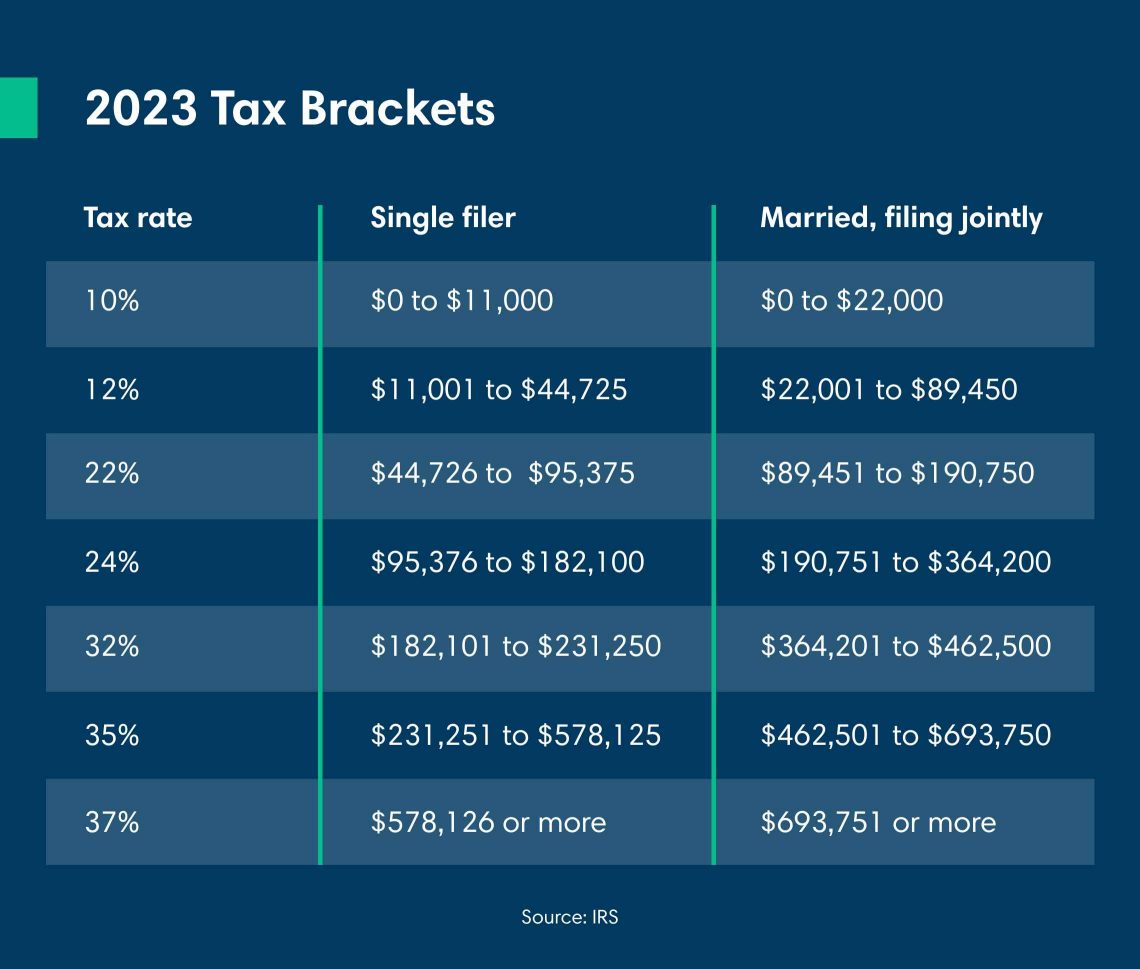

For example, if you're due for a bonus at your job in the fourth quarter that could bump you up a tax bracket, the ability to defer until January could provide substantial tax relief. If you're self-employed and know you'll need a new copier in the next 12 months, making that purchase in the current year will reduce your net income as well as accelerate Schedule C deductions to the current year.

2 Harvest investment losses

With at least 6 months of investment earnings data, you can start to make decisions about whether holding onto stocks or selling them makes the most sense from a long-term perspective as well as a current-year tax perspective. If your first-half investment performance was good but you have some holdings that haven't performed well, you may be positioned to sell some of your underperformers at a slight loss. This potentially helps offset capital gains taxes you'll owe from other investment moves.

This process is called tax-loss harvesting, and if done with care it can generate significant tax advantages. But to reap them, you'll need to follow the rules and keep your long-term investment goals firmly in mind.

IRS rules say you can use losses from investments you've held for at least a year to offset up to $3,000 in ordinary income each year until the loss is recovered with deductions.

For example, if you lose $12,000 on the sale of a stock, you could deduct up to $3,000 from your taxable ordinary income every year for 4 years. As another option, you could use the full $12,000 loss to offset gains in any tax year—which will reduce your capital gains tax for that year.

But, as with many tax moves, you need to take extra care to follow all of the rules.

For example, you might sell at a loss to attain the tax advantages of harvesting with the idea to turn around the next day and buy back what you sold at nearly the same price. Wash-sale rules stipulate that any loss-sale repurchased within 30 days can't be claimed for tax purposes, meaning you'll need to wait a month before you reinvest in that particular stock or fund—or potentially a similar fund covering the same industry or index. In that 30-day window, you're at risk of losing out to moves in the markets.

"Tax-loss harvesting can reduce tax burdens, but I caution anyone doing it to not wind up chasing every dollar to the point that tax breaks become the tail that wags the financial dog," says Reed. "A portfolio structured to help fund your kid's college in 5 years might not be of much use if you sold at a loss without rebalancing, the market soars in that 30-day wash sale window and your entire plan gets blown up."

3 Give and receive with charitable deductions

When it comes to the 20% to 60% deductions available through charitable contributions, you may already have an idea of what tax savings are possible. But if you're projecting ahead, you can further strengthen those advantages.

"With a midyear start for projections, you or your tax advisor might produce a forecast that indicates at $40,000 you'll achieve ideal tax liability, and then identify that you've provided only $20,000 of charitable contributions so far," says Reed. "Pinpointing that midyear gives you time to plan and hit that tax-advantage number you got from your forecast instead of relying on a first-of-the-year static figure."

It's important to remember that in most cases, you'll need to itemize rather than take the standard deduction in order to claim charitable deductions on your tax return, which may not be the best strategy depending on your specific situation.

Closing the gap on charitable contributions before the end of the year isn't the only tip that can help make the most of your donations. "If you're receiving required minimum distributions, or RMDs, from an IRA, you can notify the custodian to direct some of these toward charitable distributions," says Reed. "This doesn't get you a deduction, but making a $100,000 qualified charitable distribution removes that donated RMD income from your return. This goes back to accelerating expenses—and charitable contributions from RMDs are a great way to do that without bumping up a tax bracket on money you'll be penalized for not taking out."

4 Put your retirement plan to work

Where retirement plans are involved, it's not just retirees who have opportunities to reduce their tax exposure. If you're enrolled in a 401(k) plan, you may be able to write off additional contributions to your traditional IRA if your total income is low enough. Your spouse may be able to make deductible contributions to their own IRA as well. Deductibility varies depending on your specific situation and income levels, so check with a tax professional to make sure you're on solid ground.

Another potentially impactful tax savings approach is available to some business owners and those who are self-employed. "If you're self-employed, for example, and took a bad loss in a particular year, that loss will flow through your individual return. But with a midyear start and careful planning, you can use the loss to counterbalance a Roth IRA conversion," says Reed.

In other words, you may be able to use your loss as a deduction to shield yourself from income taxes you would otherwise have to pay on any amount you convert from a traditional IRA to a Roth IRA, which is typically taxed as regular income in the year you convert.

"It's a math exercise, and you're likely going to want expert guidance," Reed notes, "but if you have, for example, a $30,000 loss to report on your income tax, you might be able to utilize some of that total to shield a taxable conversion from a traditional IRA to a Roth IRA, which can create tax-free growth and withdrawals going forward."

Gather your team

In addition to getting a head start on tax season, there's one additional tip Reed emphasizes for everyone looking to maximize their tax benefits—keep professionals close at hand.

"Your insurance person, tax person, portfolio manager, tax advisor, attorney—involve as many advisors in the process as you can," says Reed. "Tax considerations extend into so many aspects of your life that bringing together professionals to address each one of them is the surest way to effectively implement these or any other tax-saving strategies."