Coronavirus Information

How We're Supporting You During COVID-19

We're here to help

Our commitment to safeguarding your money so you can focus on taking care of yourself and your family hasn't changed with the changing times. We appreciate your flexibility while we've focused on keeping you and our employees safe.

Quickly find what you need

News about advance Child Tax Credit payments

SBA Paycheck Protection Program update

Latest COVID-19 economic relief updates

July 14th, 2021: Advance Child Tax Credit Payments

Eligible families will soon receive their first monthly advance Child Tax Credit (CTC) payment through direct deposit on July 15th, 2021. The IRS will issue six CTC payments in 2021, scheduled for the following dates: July 15th, August 13th, September 15th, October 15th, November 15th and December 15th. Here are a few things to know about receiving CTC payments.

- First Citizens doesn't determine who's eligible to receive one of these payments or how much that payment will be. To determine your eligibility, or to unenroll from these payments, please refer to guidance from the IRS.

- To verify or update your bank account information for CTC payments, please use the IRS Child Tax Credit Update Portal. Updates made by August 2nd will apply to the August 13th payment and subsequent monthly payments for the rest of 2021.

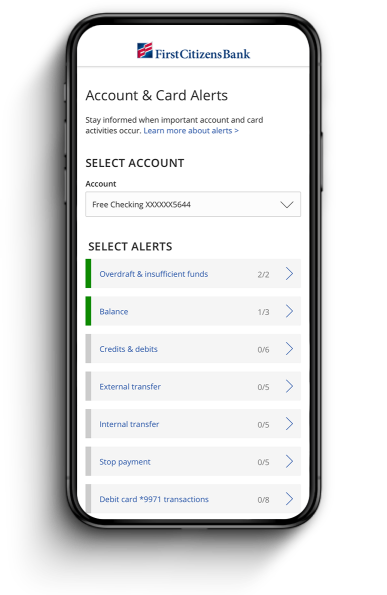

- You can set up an Account Alert in First Citizens Digital Banking and receive a text, email or both to notify you when funds above a certain amount are deposited in your account. This way, you'll know when the payment hits your account without having to take any additional action.

- If you don't receive your CTC payment by direct deposit, watch your mail for a paper check issued by the Treasury. If you receive a paper check, the easiest and most convenient way to deposit it is through our mobile banking app.

- If you receive a paper check, consider switching to direct deposit so you can receive subsequent CTC payments more quickly. Direct deposit also eliminates the risk of a lost, stolen or undelivered check, making it a more secure option.

- We urge people to be on the lookout for scams related to the Child Tax Credit. As a safety precaution, always go directly to the IRS Child Tax Credit Update Portal to update your information and don't click on links received by email or text.

- For more information about advance Child Tax Credit payments, please visit the official IRS Advance Child Tax Credit Payments in 2021 page.

Previous updates

How to get an alert when your payment arrives

If you use Digital Banking and want to be notified when your advance CTC payment is deposited in your account, it's quick and easy to set up an alert. Here's how:

- Once you log in to Digital Banking, select Alerts in the navigation menu.

- Next, choose Account Alerts.

- Select Credits & Debits, then set the alert to notify you of any credits to your account, or any credits over a certain amount. Always set the alert for $100 less than what you anticipate receiving. For example, if you're anticipating a $300 payment, we suggest you set your credit alert amount to $200. You can choose to receive alerts by text, email or both.

- Select Save.

Alerts are automatically sent in real time, so you will receive a notification as soon as funds are deposited.

How to bank with us during the pandemic

Let's stay safe together

As we continue to monitor state and local COVID-19 health and safety guidelines and conditions, our top priority remains keeping everyone safe and healthy. If you're planning on visiting a branch, we encourage you to use our branch locator to find a branch and confirm that particular location is open.

- If you aren't feeling well, or have been exposed to COVID-19, please avoid visiting a branch.

- While visiting, please stay at least six feet away from others and avoid physical contact like shaking hands.

- Our facilities are frequently and thoroughly cleaned for your safety and ours.

- Our ATMs and drive-thru service are great options for checking and savings transactions.

Manage your accounts online

First Citizens Digital Banking can help you manage your accounts online anytime, anywhere from your connected devices.

- View balances, make payments, transfer funds, and update your profile and contact information.

- Deposit checks from your mobile device using our Digital Banking app.

- Manage your card, lock your card, and report a lost or stolen card.

Bank with us by phone

Call our 24-hour automated banking line at 888-FC DIRECT (888-323-4732). Customer service representatives are available from 7 am to 11 pm ET.

If you need support for a particular issue, we're here to help. You can find important phone numbers for credit cards, insurance, business and more by clicking the button below.

Tips for keeping your money safe

Protect your personal info

In circumstances like these, it's even more important to be aware and on guard for potential scams and fraud.

- Never give your personal information out to people who contact you unsolicited by phone, email or otherwise.

- Don't share any of your login IDs or passwords.

To learn more about protecting your personal information, check out our insights on Privacy and Security.

Always verify who's calling

Fraudsters can use spoofed phone numbers and caller IDs to impersonate a bank. They call from a number that appears to be the bank and ask for confidential information (account numbers, online banking credentials, etc.), which they use for fraudulent purposes.

- Whenever you get a call appearing to be from your bank, be careful to ensure it actually is from your bank—especially if you are asked to provide personal information.

- When in doubt, it's best to hang up and call them back at the number provided on their website or on the back of your credit or debit card.

Guard yourself online

- Avoid opening attachments or clicking on links within emails and text messages, especially from people or organizations you don't know.

- Be wary of messages from seemingly legitimate sources—such as your bank, the CDC, World Health Organization and US Treasury—that require you to log in to view information or encourage you to provide personal identifying information. This is a common scam tactic.

- Rely on trusted sources for information about the virus, not posts you see on social media. Visit cdc.gov or who.int for the most accurate information.

Report fraud immediately

It's important to report scams quickly to protect yourself and others from ongoing fraudulent activity.

If you suspect you've been a victim of fraud, call us at 888-FC DIRECT.

More resources

PPP updates

Read the latest information regarding the SBA's paycheck protection program.

We can help

Need financial assistance? Call your local branch or contact us to get started.

Market outlook

Read more about the impact of the CARES Act and our outlook for the road ahead.