Commercial Savings

Manage your cash flow and improve your bottom line

Maximize interest earnings with commercial savings

Commercial savings is best suited for businesses focused on earning interest on reserves, while also maintaining liquidity. We offer account options for a variety of different savings needs, all backed by the financial expertise our customers expect and deserve.

Savings growth

Retain more earnings with a high-yield savings account that will grow with your business.

Money market savings

Maximize your savings potential with tiered interest rates.

Certificates of deposit

Get steady interest rates and flexible terms to meet your business needs.

You've worked hard to grow your business

Products for every stage

We can help you manage your cash flow. With options for both short- and long-term commercial savings needs, you can rest easy knowing your liquid savings are secure.

Practical saving options

A sensible savings account is perfect for businesses of any size. A premium savings account offers the flexibility for your interest rate to grow right along with your money. Business certificates of deposit give your small business the ability to save for the future, with a variety of flexible terms available.

Best in class banking solutions

We understand how hard you work. Having a reliable financial partner can help take some of that stress off your plate and improve your bottom line. That's why we offer a variety of sensible commercial savings options.

Let's start a conversation—we're here to help

Commercial Advantage

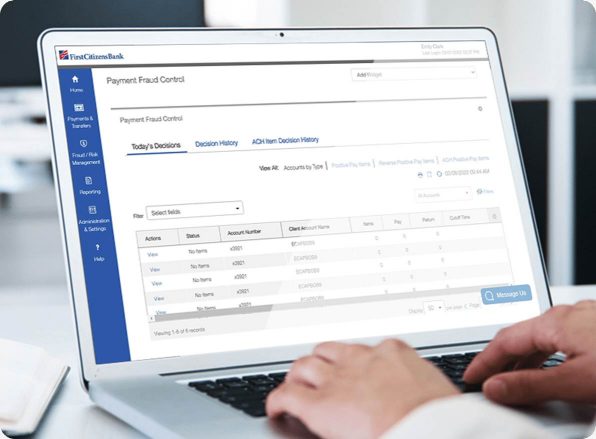

Accurately track cash flow

Manage your business on the go

Keep your assets secure