ach positive pay (ach monitor)

Protect your business accounts from electronic fraud

Stay aware

Monitor accounts against potentially fraudulent transactions.

Stop activity

Block any unauthorized transactions.

Get alerts

Receive proactive notifications against suspicious activity.

Take control

Protect accounts

Choose from several options to protect your account.

Handle cash flow

Manage cash flow by viewing and approving transactions before they post.

Explore more options

Safeguard your account with filter, block and SEC Filter options.

Protect your accounts

We provide several ACH Positive Pay services to help you block and return any unauthorized electronic transactions.

Filter

Review ACH transactions within Commercial Advantage or Digital Banking to decide whether to pay the transaction and allow it to post to your account or reject it and have it returned to the originator.

SEC Filter

Block only those ACH transactions that you request with specific ACH Standard Entry Class, or SEC, codes from posting to your business account.

Block

Available in Commercial Advantage, you can automatically block and return all ACH debit and credit transactions that attempt to post to your business account.

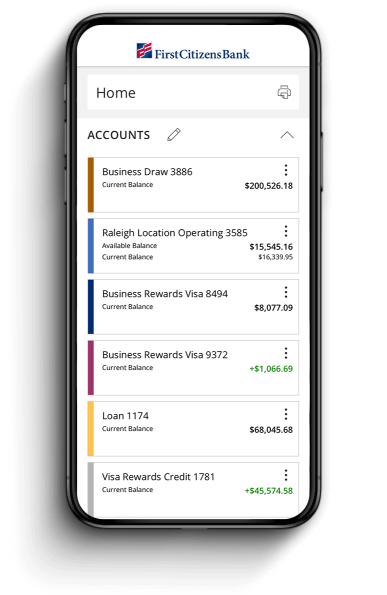

Manage your business on the go

Manage your accounts from anywhere

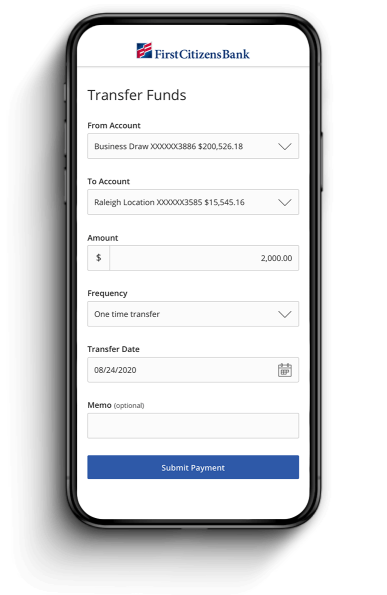

Send and transfer money using ACH and wires

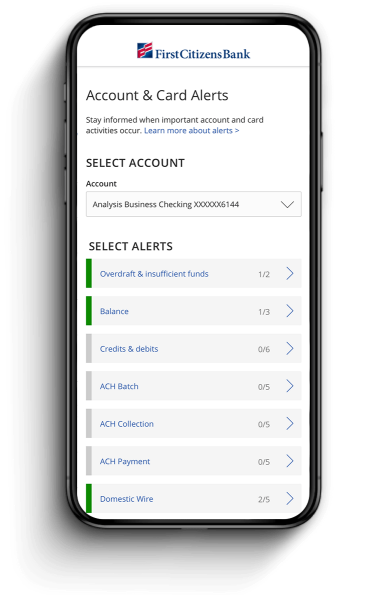

Receive account and security alerts